Dr. Adam J. Fein, CEO of Drug Channels Institute (DCI) and the author of

Drug Channels, invites you to join him for a new video webinar:

PBMs and the Battle Over Patient Support Funds:

Accumulators, Maximizers, and Alternative Funding

This event will be broadcast live on

Friday, June 23, 2023, from 12:00 p.m. to 1:30 p.m. ET.

This page describes the event and explains how to purchase a registration. The webinar will be broadcast from

the Drug Channels studio in beautiful downtown Philadelphia.

This event is part of

The Drug Channels 2023 Video Webinar Series.

WHAT YOU WILL LEARN

As expensive specialty therapies come to dominate drug spending, pharmaceutical manufacturers are paying a growing share of patents’ out-of-pocket costs for these prescriptions. At the same time, plans and PBMs are turning to novel—and often controversial—benefit design tools that access manufacturers’ patient support spending.

Join Dr. Fein as he helps you and your team deepen your understanding of this complex subject and its crucial implications for drugmakers, payers, PBMs, and patients. During the event, Dr. Fein will cover a wide range of topics, including:

- What’s driving patients’ out-of-pocket obligations

- Trends in the value of manufacturers’ financial assistance

- Copayment offset programs vs. patient assistance programs (PAPs)

- Conventional pharmacy benefit management tactics

- The new tools that offset specialty drug costs: copay accumulators, maximizers, and alternative funding programs

- The latest market data on adoption of the new spending drug management tools

- Prescription economics of copay accumulators, maximizers, and alternative funding programs

- How PBMs profit from—and are challenged by—the new tools

- Plan sponsor perspectives

- State and federal legislation over pharmacy benefits

- Major lawsuits between manufacturers and vendors

- Outlook for specialty drug spending management

- Controversies and unresolved questions

PLUS: During the webinar, Dr. Fein will give participants an opportunity to unmute themselves and ask live questions. The webinar will last 90 minutes to accommodate audience questions.

As always, Dr. Fein will clearly distinguish his opinions and interpretations from the objective facts and data. He will draw from exclusive information found in DCI's

2023 Economic Report on U.S. Pharmacies and Pharmacy Benefit Managers.

Read on for full details on pricing and registration.

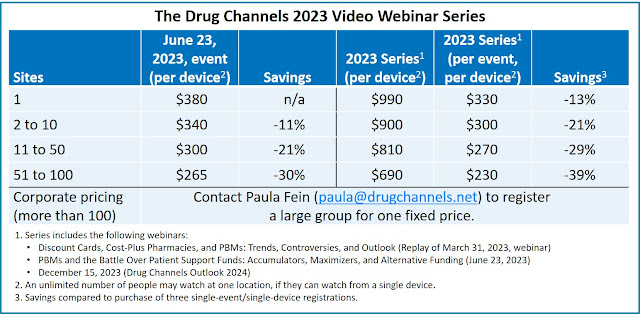

PRICING OPTIONS

You can register for this unique educational opportunity for only $380 per viewing device. Within 24 hours of your purchase, you will receive an email from Zoom with a unique link to access the live event.

We are offering substantial discounts for multiple registrations from the same organization. We know that many of you may be working remotely, so rates for multiple registrations are as low as $265 per device—a 30% savings. An unlimited number of people may watch at one physical location if they can watch from a single device. Please note that a device at a single physical location may not stream, share, or project our webinar to other sites. Each device at a physical location requires its own registration.

Click here to order. All discounts will be automatically computed based on the number of registrations you enter in your cart. (You can reset the cart by entering 0 in the quantity field.)

Please contact

Paula Fein (paula@drugchannels.net) if you have any questions. If you purchase access for multiple devices, we will contact you for a list of your participants and their email addresses. Or,

download this spreadsheet and email your registrants’ information to Tamra Feldman (

admin@drugchannels.net).

Click here to register for the full Drug Channels 2023 Video Webinar Series

Payment can be made with all major credit cards (Visa, MasterCard, American Express, and Discover) or via PayPal.

Click here to email us if you would like to pay by corporate purchase order or check.

IMPORTANT THINGS TO KNOW

- Watch and listen via any device with a web browser (computer, iPad, iPhone/Android, etc.) There is no access via telephone.

- We use Zoom technology for this webinar. Every registrant will receive an email from Zoom with a link to watch the event. This link is unique to the registrant and can only be accessed once. We recommend that every registrant download the Zoom client software/app.

- Within one day of purchasing a registration, each registrant will receive an email from Zoom with a link to access the event and add it to their calendar. Every registrant will also receive reminder emails from Zoom one week, one day, and one hour before the event.

- This event is part of The Drug Channels 2023 Video Webinar Series. If you have already purchased the full series, then you should have received an email from no-reply@zoom.us with your unique link to access the June event.

- Organizations that purchased corporate access for The Drug Channels 2023 Video Webinar Series will receive a custom, branded signup link so employees can easily register. We will automatically refund payments from anyone at a company with corporate access who purchases a single registration using their corporate email account.

- Unfortunately, we are unable to offer refunds.

.jpg)