Here’s the game: A commercial plan eliminates coverage for all specialty drugs. Beneficiaries are then shunted over to a charitable foundation, because they are now disguised as uninsured—at least for specialty drugs. Naturally, the vendor skims a healthy share of the charity’s money.

In addition to the ethical and compliance issues, some vendors raise safety risks by sourcing prescriptions from non-U.S. pharmacies as a backup.

The Orwellian euphemism for this “benefit” design: alternative funding program.

A new survey reveals that an astounding four out of 10 commercial plans are already using, or exploring the use of, these specialty carve-out programs. Yikes.

Read on for an overview of these shady programs—and the many problems they are creating.

PAP 101

Patient assistance programs (PAP) focus on patients who meet financial eligibility criteria—those without insurance and those denied coverage by their commercial plans. PAPs therefore differ from copayment offset programs that cover a commercially insured beneficiary’s out-of-pocket costs. Copayment offset programs may not be used by beneficiaries of any federal healthcare program, including Medicare Part D. PAPs can, however, support patients with government-sponsored insurance.

PAPs are often incorporated as 501(c)(3) nonprofit charitable foundations. Exhibit 122 of our 2022 Economic Report on U.S. Pharmacies and Pharmacy Benefit Managers lists 10 of the largest PAPs funded by pharmaceutical manufacturers. These organizations have been subject to controversy about their operations.

For more on the economics of manufacturer's out-of-pocket support, see our 2022 pharmacy/PBM report.

MASTERS OF DISGUISE

PAPs enable specialty carve-outs, also known as alternative funding programs (AFP). Here’s how the scheme works:

- Some or all specialty drugs are administered by a secretive third-party vendor that is separate from the commercial plan’s PBM. Examples of these players include ImpaxRx, PaydHealth, PayerMatrix, RxFree4me, SHARx (an aptonym?), and Script Sourcing. (I won't promote these companies by linking to their uninformative web sites.)

- These specialty drugs are excluded from the plan’s formulary, so that a patient technically has no coverage for the specialty drug.

- The third-party vendor helps the patient disguise themselves as “uninsured” so they can apply for the manufacturer’s PAP funds to cover the cost of the prescriptions. (When contacting the manufacturer, I have heard that some vendors will even impersonate the patient.) These prescriptions are typically filled by noncommercial pharmacies that are operated by specialty hub service companies funded by the manufacturer.

- The manufacturer ends up paying the full cost of the prescription and the pharmacy services. Meanwhile, the plan sponsor incurs no costs for the specialty drug.

- I estimate that the third-party vendors retain up to 20% to 25% of a drug's full list price, i.e., the value of charitable funds provided to the patient. Some may get paid a generous per-employee, per-month fee.

You will surely not be surprised to learn that these vendors’ webpages never really explain how drug savings are generated—or how the vendors earn their profits.

MONEY FOR ME, NOT THEE

To evaluate the prevalence of specialty carve-out programs, we again rely on Trends in Specialty Benefit Design, the excellent recent report from Pharmaceutical Strategies Group (PSG). (The report is free with registration.) This survey, which was conducted in mid-2021, included 171 employers, unions, and commercial plans that represented 40.4 million covered lives.

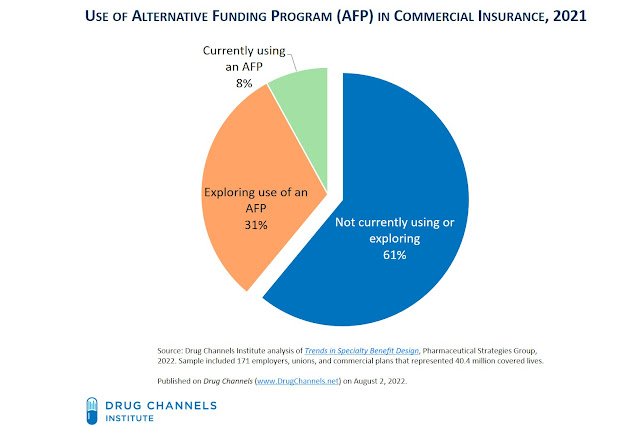

The survey asked directly about alternative funding programs. As you can see below, 8% of plans are already using AFPs, while a further 31% are exploring their use.

As far as I know, this survey represents the only public data on the current use of AFPs. While there is no historical data, I believe that the use and interest in these programs has grown dramatically in the past few years. I’ve been told that some benefit consultants are including specialty carve-out programs in their RFP responses for the 2023 and 2024 plan years.

WHAT’S WRONG?

Some payers will probably see no problem here. They justify sticking it to “big pharma” by getting free drugs for their beneficiaries.

However, these programs can have significant downsides for both plans and patients:

As I noted during last week’s Specialty Drugs Update: Trends, Controversies, and Outlook webinar, carve-outs are the latest example of how plans and PBMs want to use manufacturers’ copay support and patient assistance programs as a source of funding and profits.

MONEY FOR ME, NOT THEE

To evaluate the prevalence of specialty carve-out programs, we again rely on Trends in Specialty Benefit Design, the excellent recent report from Pharmaceutical Strategies Group (PSG). (The report is free with registration.) This survey, which was conducted in mid-2021, included 171 employers, unions, and commercial plans that represented 40.4 million covered lives.

The survey asked directly about alternative funding programs. As you can see below, 8% of plans are already using AFPs, while a further 31% are exploring their use.

[Click to Enlarge]

As far as I know, this survey represents the only public data on the current use of AFPs. While there is no historical data, I believe that the use and interest in these programs has grown dramatically in the past few years. I’ve been told that some benefit consultants are including specialty carve-out programs in their RFP responses for the 2023 and 2024 plan years.

WHAT’S WRONG?

Some payers will probably see no problem here. They justify sticking it to “big pharma” by getting free drugs for their beneficiaries.

However, these programs can have significant downsides for both plans and patients:

- Commercial payers are accessing need-based funds from charitable foundations that were established to help underinsured and uninsured patients. Truly needy patients must compete for PAP funds with financially sound payers and patients who would not otherwise be eligible for charitable support.

- Patients often face treatment delays due to the application process for PAP funds. They may also be encouraged to use the product with a more favorable PAP program rather than the most clinically appropriate product.

- Plan sponsors incur higher administration costs, because the carve-out vendor must coordinate with the primary PBM that is administering the pharmacy benefit. The plan sponsor also faces higher plan costs due to higher fees or lower rebates and discounts from their PBM.

ICYMI, I explained why pharmacy benefit managers (PBMs) prefer copay maximizers to specialty carve-out programs in Four Reasons Why PBMs Gain As Maximizers Overtake Copay Accumulators.

- Third-party vendors can earn a big chunk (20% to 25%) of the total PAP funds provided by the manufacturer. Like the secretive vendors behind copay maximizer programs, the carve-out vendors rake in egregious fees that are highly disproportionate to the costs of their activities. These fees come from the plan.

- Self-insured plans face numerous ERISA and IRS-related compliance issues. Click here for a helpful overview of these issues from Vivio Health. This document also warns: "Manufacturers and agencies providing alternative funding may claim misrepresentation because alternative funding depends on recipients having no insurance." Plans are also taking enormous safety risks by enabling carve-out vendors to source prescriptions from unlicensed and unsafe overseas pharmacies.

As with many seedy corners of the drug channel: It’s good money, if you can get away with it. Unfortunately, patients and plan are the losers from programs that misrepresent the patient's true financial situation while undermining the intent and operations of charitable patient assistance programs.

CORRECTION: The text has been updated to reflect that fact that the AFP vendor's fees are paid by the plan sponsor, not the charitable foundation.

CORRECTION: The text has been updated to reflect that fact that the AFP vendor's fees are paid by the plan sponsor, not the charitable foundation.

No comments:

Post a Comment