This makes it a good time to review the murky, little-seen economics of how commercial plan sponsors and payers access the billions of dollars in manufacturer rebates and fee that are negotiated by their pharmacy benefit managers (PBMs).

Our analyses of new Texas-mandated PBM disclosures reveal that plan sponsors receive most of the rebates, fees, and other payments from manufacturers. However, PBMs retain an unexpectedly large share of these payments—while the patients whose prescriptions generated these funds get almost nothing.

In other words, plans spread around manufacturers’ rebates and fees to offset premiums for all beneficiaries, rather than lower out-of-pocket costs for drugs that plans buy at a discounted price. Perhaps Congress will someday get around to corralling these funds.

THE REBATES AT NIGHT

Over the past five years, there has been a spike in state legislation targeting various aspects of the U.S. drug channel and its participants. Many states have passed laws that require manufacturers, PBMs, and/or others to submit certain information to states. The laws vary, but they include reporting of such items as drug prices, gross spending, net spending, and/or rebates. I highlight this trend in Section 12.3.3. of our 2022 Economic Report on U.S. Pharmacies and Pharmacy Benefit Managers.

A surprising number of laws require the reporting of drugs’ wholesale acquisition cost (WAC) list prices. Just a thought: Rather than building a new state bureaucracy, those states’ taxpayers would have been better off with a subscription to the data readily available from multiple publishers of drug pricing metric benchmarks.

Some states have more helpfully attempted to provide transparency into data that are not otherwise publicly available. Alas, many of these laws have ended being useless, because they are either poorly drafted or lack enforcement mechanisms.

Consider the reporting required by Nevada Senate Bill 539. The bill stipulates that the Nevada Department of Health and Human Services (DHHS) compile and publish certain information regarding “prescription drugs essential for treating diabetes” in the state. For 2017, PBMs reported $1.8 billion in negotiated commercial rebates in Nevada. But for 2020, PBMs reported only $21.8 million in negotiated rebates—an implausible 99% decline in rebates for diabetes products. When I emailed Nevada's DHHS to ask why rebates plummeted, they just shrugged (via email) and said they have no way to validate or audit anything. Oh well.

SHINE BIG AND BRIGHT

To its credit, Texas has somehow compelled widespread compliance with its Insurance Code Section 1369.502, which requires PBMs to file annual reports on rebates, fees, and other payments. You can find information about the program on this Texas Department of Insurance website: Pharmaceutical benefits reporting.

Under the Texas code, PBMs are required to report the “aggregated rebates, fees, price protection payments, and any other payments collected from pharmaceutical drug manufacturers” and the breakdown of these payments into three mutually exclusive categories:

- Payments passed through to plan sponsors

- Payments retained as revenue by the PBMs

- Payments provided to plan beneficiaries at the point-of-sale

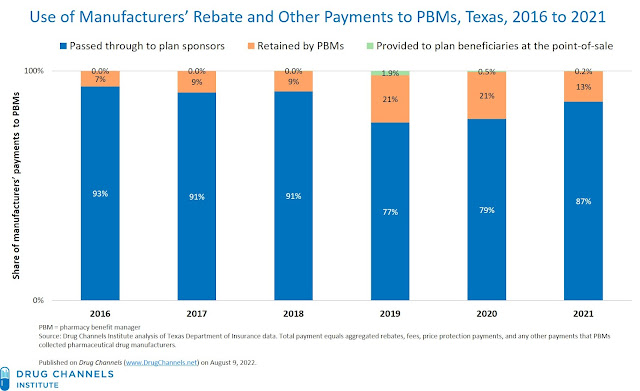

We examined the Texas reports on PBM rebates from calendar years 2016 to 2019, 2020, and 2021.

We found some quirks in these data. For 2016 to 2019, the total reported annual rebate payments ranged from $558 million to $857 million from 18 PBMs. For 2020, total annual rebates jumped to $2.3 billion from 24 PBMs. For 2021, reported rebates jumped again, to $5.7 billion from 13 PBMs.

Despite these variations, the data tell a compelling and fairly consistent tale about what happened to the manufacturers' payments to PBMs.

[Click to Enlarge]

Observations:

- Payers received most the money collected by PBMs. As you can see, PBMs passed through about 80% to 90% of manufacturers’ payments. The Texas data are directionally consistent with employer surveys and public disclosures by CVS Health and Cigna’s Express Scripts business. For details, see Section 9.1.1. of our 2022 pharmacy/PBM report.

- PBMs retained an unexpectedly larger share of manufacturers’ payments. For 2021, PBMs retained $752 million (13%) of manufacturers’ total payments. This share has ranged from 9% to 21% over the six years. These figures seem higher than PBMs’ public disclosures. A few years ago, both CVS and Express Scripts claimed to be returning 95% or more of rebates.

I suspect the discrepancy stems from the public companies’ carefully worded statements about the share of “rebates” passed through to plan sponsors. That's one reason that DCI estimates that fees and other payments from manufacturers have become crucial to PBMs’ profitability, per Section 11.2.3. of our 2022 pharmacy/PBM report. In the past few years, PBMs have developed group purchasing organizations that charge administrative, data, enterprise, and other fees to manufacturers. These businesses and their finances are less transparent to plan sponsors, so we estimate that a smaller share of those revenues are passed through to plan sponsors.

- Payers continue to hoard rebates. A teeny amount of manufacturers’ funds were shared directly with the beneficiaries whose prescriptions generated the rebate funds. For 2021, only $11.9 million (0.2%) out of $5.7 billion in manufacturer payments were shared as point-of-sale savings to plan beneficiaries. This result should not surprise long-time readers of Drug Channels. Plans prefer to use rebates and other payments to offset nondrug healthcare costs and reduce general premiums, rather than offset the prices paid by patients whose prescriptions generated the rebate funds.

Consider Employers Are Getting More Rebates Than Ever—But Sharing Little With Their Employees (from January 2018), which summarized a 2017 employer survey. More than two-thirds of employers used rebate payments to offset overall spending on drug costs, while 11% used rebates to offset member premiums for all employees. A small minority (15%) split the savings with members. BTW, that article is also notable for containing my favorite Lord of the Rings references.

Different plan sponsors have varying preferences for how the value of rebates is reflected in their pharmacy benefit spending. But the Texas data show that there have been few new developments in plan sponsors’ usage of manufacturers’ rebates.

Perhaps that’s why the PBMs cry, “Ki-yip-pee-yi,” deep in the heart of Texas.

No comments:

Post a Comment