- Mark Cuban!

- Novo Nordisk confronts the gross-to-net bubble

- CVS Health finally acknowledges its profits from the 340B program

P.S. Please join the nearly 13,500 consumers of my daily commentary and links to neat stuff at @DrugChannels on Twitter. You can also find my daily posts on LinkedIn, where I am approaching 25,000 followers.

Basketball billionaire enters the no-insurance, no-middleman drug business, Ohio Capital Journal

Have you heard the word? Billionaire/celebrity/investor/bon vivant Mark Cuban just launched a much-hyped cash-pay mail pharmacy.

Nearly every article about this venture has done no more than breathlessly repeat the press release highlights. By contrast, Marty Schladen’s article linked above provides some crucial context. As he astutely points out, Cuban’s new venture mirrors work done by such small, independent pharmacies as Blueberry Pharmacy, Freedom Pharmacy, and GenScripts Pharmacy.

Another intriguing detail via Endpoints: Mark Cuban's new cost-plus-15% generic drug company is really a compounding pharmacy. Hmm.

I’m not clear on how Mark Cuban will carve out a unique spot in an increasingly crowded and highly competitive generic market. Consider Amazon, which has so far failed to disrupt the pharmacy or PBM industries.

What’s more, GoodRx CEO Doug Hirsch claims that prescriptions using the GoodRx discount card at retail pharmacies are cheaper than prescriptions from the mail pharmacies of both Amazon and Mark Cuban’s cost-plus venture. See Why lowering drug prices is harder than it looks. (I have not validated Doug's figures.)

I’ll have more details on competition for patient-paid prescriptions in DCI’s forthcoming 2022 Economic Report on U.S. Pharmacies and Pharmacy Benefit Managers.

Nearly every article about this venture has done no more than breathlessly repeat the press release highlights. By contrast, Marty Schladen’s article linked above provides some crucial context. As he astutely points out, Cuban’s new venture mirrors work done by such small, independent pharmacies as Blueberry Pharmacy, Freedom Pharmacy, and GenScripts Pharmacy.

Another intriguing detail via Endpoints: Mark Cuban's new cost-plus-15% generic drug company is really a compounding pharmacy. Hmm.

I’m not clear on how Mark Cuban will carve out a unique spot in an increasingly crowded and highly competitive generic market. Consider Amazon, which has so far failed to disrupt the pharmacy or PBM industries.

What’s more, GoodRx CEO Doug Hirsch claims that prescriptions using the GoodRx discount card at retail pharmacies are cheaper than prescriptions from the mail pharmacies of both Amazon and Mark Cuban’s cost-plus venture. See Why lowering drug prices is harder than it looks. (I have not validated Doug's figures.)

I’ll have more details on competition for patient-paid prescriptions in DCI’s forthcoming 2022 Economic Report on U.S. Pharmacies and Pharmacy Benefit Managers.

Annual Report 2021, Novo Nordisk

Here’s further evidence that the public discussion of drug pricing is outdated and inaccurate.

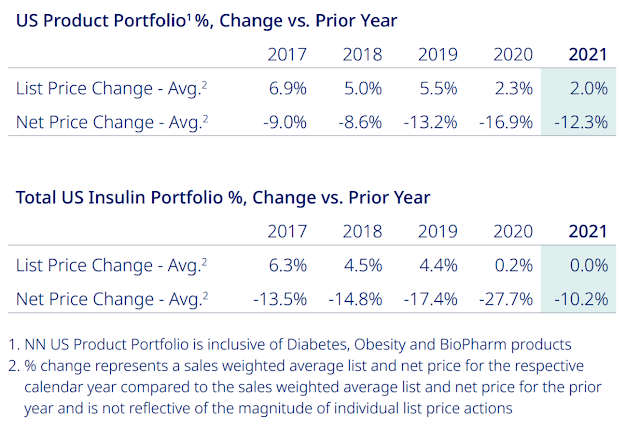

Novo Nordisk reported that for 2021, average list prices for its U.S. product portfolio grew by only 2.0%, while net prices dropped by 12.3%. (See the table below, from page 16 of its 2021 annual report.) List prices for its insulin products were unchanged, but net prices dropped by 10.2%.

These data are consistent with industry-wide trends, which show net brand-name drug prices dropping for the past four years. See Tales of the Unsurprised: Brand-Name Drug Prices Fell for the Fourth Consecutive Year.

Alas, our politicians and journalists will undoubtedly continue to scream about “skyrocketing drug prices.”

Novo Nordisk reported that for 2021, average list prices for its U.S. product portfolio grew by only 2.0%, while net prices dropped by 12.3%. (See the table below, from page 16 of its 2021 annual report.) List prices for its insulin products were unchanged, but net prices dropped by 10.2%.

[Click to Enlarge]

These data are consistent with industry-wide trends, which show net brand-name drug prices dropping for the past four years. See Tales of the Unsurprised: Brand-Name Drug Prices Fell for the Fourth Consecutive Year.

Alas, our politicians and journalists will undoubtedly continue to scream about “skyrocketing drug prices.”

2021 10-K Filing, CVS Health

In DCI’s review of contract pharmacies in the 340B Drug Pricing Program, we observed that more than 6,500 CVS Health retail, mail, and specialty pharmacy locations act as 340B contract pharmacies. Combined, these locations have more than 36,000 relationships with covered entities. This business translates into big profits for CVS Health, as I explain in How Hospitals and PBMs Profit—and Patients Lose—From 340B Contract Pharmacies.

The many problems associated with 340B contract pharmacies have motivated manufacturers to alter policies regarding 340B discounts available at contract pharmacies. So far, 14 manufacturers have announced policies related to covered entities’ contract pharmacies. These controversial actions are the subject of multiple litigations.

Consequently, CVS Health has finally been forced to acknowledge the role of 340B in its operations. Its latest 10-K annual report contains multiple references to the 340B program, including the following notable new disclosure:

The many problems associated with 340B contract pharmacies have motivated manufacturers to alter policies regarding 340B discounts available at contract pharmacies. So far, 14 manufacturers have announced policies related to covered entities’ contract pharmacies. These controversial actions are the subject of multiple litigations.

Consequently, CVS Health has finally been forced to acknowledge the role of 340B in its operations. Its latest 10-K annual report contains multiple references to the 340B program, including the following notable new disclosure:

“A reduction in Covered Entities’ participation in contract pharmacy arrangements, as a result of the pending enforcement actions or otherwise, a reduction in the use of the Company’s administrative services by Covered Entities, or a reduction in drug manufacturers’ participation in the program could materially and adversely affect the Company.”I have long argued that the 340B program needs to be modernized so that it benefits seniors and other patients—while supporting the genuine safety-net services of health-care providers. Consider CVS Health’s disclosure to be another sign that the long-overdue reform of the 340B program may finally be getting closer.

Chart of the day…or century?, American Enterprise Institute

Here’s the latest update to my all-time favorite chart via Mark Perry of the American Enterprise Institute.

So much to ponder! Services vs. manufacturing? Government vs. free market? Domestic vs. international competition? Healthcare/education vs. everything else?

Fun fact: My LinkedIn post about this chart generated 60 comments, more than 650 reactions, and over 61,000 views.

So much to ponder! Services vs. manufacturing? Government vs. free market? Domestic vs. international competition? Healthcare/education vs. everything else?

[Click to Enlarge]

Fun fact: My LinkedIn post about this chart generated 60 comments, more than 650 reactions, and over 61,000 views.

No comments:

Post a Comment