- Fresh evidence of patients’ copay maximizer pain

- How payers pay more to hospitals than to physician offices

- Surprise? Rationing care via bureaucracy saves money

P.S. Join my more than 44,000 LinkedIn followers for daily links to neat stuff. You can also find my daily posts at @DrugChannels on Twitter/X, where I have more than 16,700 followers. (I recommend that you follow me on LinkedIn, because the quality of comments and engagement is much higher than they are on Twitter. I’m not posting to Threads yet.)

Patients already paying price for PBMs diverting copay cash meant for needy, Darrel Rowland for ABC6

I’m a long-time fan of journalist Darrel Rowland. Here’s the third-part of his investigation into the new tools—copay accumulators, maximizers, and alterative funding programs—that plans and pharmacy benefit managers (PBMs) are using to offset specialty drug costs. Darrel provides troubling examples of how patients have suffered from these tools.

The rest of the series is also worth your time:

The rest of the series is also worth your time:

The 2023 State of Specialty Spend and Trend Report, Pharmaceutical Strategies Group

As I have noted many times on Drug Channels, commercial payers use reimbursement approaches that permit hospitals to markup specialty drug costs by thousands of dollars per claim when compared with physician offices. Hospitals often earn more than the drug’s manufacturer, when outrageous mark-ups are combined with discounted 340B Drug Pricing Program acquisition costs.

The chart below summarizes data from the new 2023 State of Specialty Spend and Trend Report on commercial reimbursement rates at different sites of care, compared to average sales price (ASP). The reimbursement rate at different sites of care was normalized to the ASP, regardless of the methodology used to compute reimbursement.

For 2022, commercial health plans reimbursed hospitals at the equivalent of 199% of a drug’s ASP and paid administration fees of $429. Physician offices were reimbursed at the equivalent of only 124% of a drug’s ASP and were paid fees of $129. Home infusion received lower drug reimbursement rates and lower administration fees.

P.S. The report has loads of great data on specialty benefits. Just be cautious. Much of the data excludes rebates, so the cost figures do not necessarily reflect actual underlying spending trends.

The chart below summarizes data from the new 2023 State of Specialty Spend and Trend Report on commercial reimbursement rates at different sites of care, compared to average sales price (ASP). The reimbursement rate at different sites of care was normalized to the ASP, regardless of the methodology used to compute reimbursement.

[Click to Enlarge]

For 2022, commercial health plans reimbursed hospitals at the equivalent of 199% of a drug’s ASP and paid administration fees of $429. Physician offices were reimbursed at the equivalent of only 124% of a drug’s ASP and were paid fees of $129. Home infusion received lower drug reimbursement rates and lower administration fees.

P.S. The report has loads of great data on specialty benefits. Just be cautious. Much of the data excludes rebates, so the cost figures do not necessarily reflect actual underlying spending trends.

Rationing Medicine Through Bureaucracy: Authorization Restrictions In Medicare, NBER working paper 30878

Oy. A new academic working paper “discovers” that rationing drugs via prior authorization bureaucracy reduces drug spending. While I understand the authors’ economic logic, I still found the paper to be a scary articulation of what we all think occurs at insurance companies. My LinkedIn post about this paper generated a robust discussion.

If you dislike math, then I suggest you watch Dr. Glaucomflecken’s brief summary of the paper’s key message:

If you dislike math, then I suggest you watch Dr. Glaucomflecken’s brief summary of the paper’s key message:

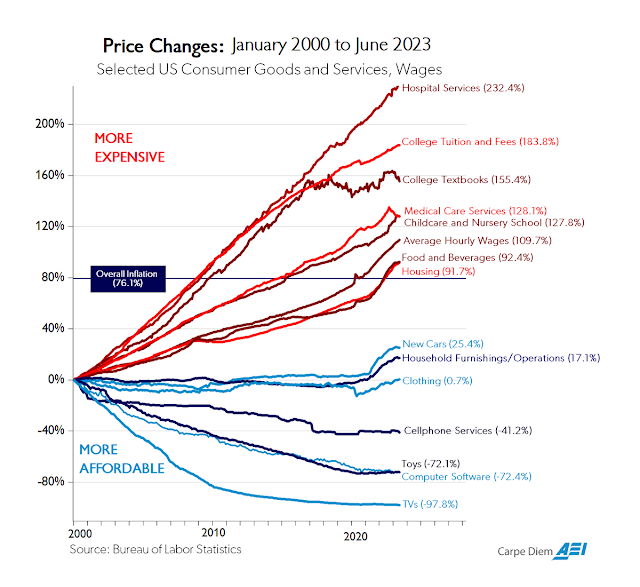

Chart of the day…or century?, American Enterprise Institute

Here’s the June 2023 update to my all-time favorite chart from Mark Perry of the American Enterprise Institute. As you can see, inflation has been much higher for domestic services that rely heavily on government funding. "Nonprofit" hospitals and colleges remain in the lead!

[Click to Enlarge]

No comments:

Post a Comment