- SaveonSP gets sued

- Thoughts on the Medicaid accumulator rule opinion

- CVS buys AmerisourceBergen’s specialty pharmacy

- Fresh data on hospitals’ cancer drug profiteering

P.S. Join my more than 27,000 LinkedIn followers for daily links to neat stuff. You can also find my daily posts at @DrugChannels on Twitter, where I have more than 14,000 followers.

J&J Sues Drug-Benefit Middleman Over Use of Drug-Cost Assistance Program, The Wall Street Journal

Whoa. A subsidiary of Johnson & Johnson (JNJ) has sued SaveonSP, the controversial and secretive copay maximizer partner of Express Scripts. This move represents a significant escalation of the battle over manufacturers’ copay support. As one of JNJ’s attorneys states: “Patient assistance should be for patients, not for payers.”

Those who follow the debate over copay support should read the entire complaint: JOHNSON & JOHNSON HEALTH CARE SYSTEMS INC. vs. SAVE ON SP, LLC (Case 2:22-cv-02632).

The complaint cites a highly revealing SaveonSP training video, which provides crucial context for understanding how copay maximizers really work. (Note that the deck was presented on an Express Scripts slide template.) The video also confirms that SaveonSP/Express Scripts earns fees equal to 25% of the manufacturer’s copay support program. Listen carefully at around 40:50. We don’t know how this excessive fee is split between SaveonSP and Express Scripts.

For my latest update on maximizers, see Four Reasons Why PBMs Gain As Maximizers Overtake Copay Accumulators.

Those who follow the debate over copay support should read the entire complaint: JOHNSON & JOHNSON HEALTH CARE SYSTEMS INC. vs. SAVE ON SP, LLC (Case 2:22-cv-02632).

The complaint cites a highly revealing SaveonSP training video, which provides crucial context for understanding how copay maximizers really work. (Note that the deck was presented on an Express Scripts slide template.) The video also confirms that SaveonSP/Express Scripts earns fees equal to 25% of the manufacturer’s copay support program. Listen carefully at around 40:50. We don’t know how this excessive fee is split between SaveonSP and Express Scripts.

For my latest update on maximizers, see Four Reasons Why PBMs Gain As Maximizers Overtake Copay Accumulators.

Pharmaceutical Research and Manufacturers of America v. Xavier Becerra, et al. (Civil Action No. 1:21-cv-1395): Memorandum Opinion, United States District Court For The District Of Columbia

As many Drug Channels readers surely know, a federal judge recently vacated the U.S. Department of Health and Human Services’ (HHS) Medicaid accumulator rule. The rule, which was to take effect in January 2023, would have required manufacturers to include all patient support funds in the computation of Medicaid best price—unless the manufacturer could somehow ensure that the full value of the assistance or benefit had been passed on to the consumer or patient. I doubt that HHS will appeal this troubled rule, which was disliked by just about everybody.

In the meantime, I highly recommend that you read the material in Section IV of the opinion linked above. Judge Nichols writes:

I’m not a lawyer, but this judicial reasoning seems relevant to the 340B contract pharmacy lawsuits. Might be a good time to brush up on Chevron deference.

In the meantime, I highly recommend that you read the material in Section IV of the opinion linked above. Judge Nichols writes:

“A manufacturer’s financial assistance to a patient does not qualify as a price made available from a manufacturer to a best-price-eligible purchaser. Rather, a manufacturer’s financial assistance is available from the manufacturer to the patient. And a patient is not a best-price eligible purchaser. As a result, HHS lacks the statutory authority to adopt the accumulator adjustment rule.”The judge further notes that HHS’ “…interpretation, however, stretches the statutory text too thin.”

I’m not a lawyer, but this judicial reasoning seems relevant to the 340B contract pharmacy lawsuits. Might be a good time to brush up on Chevron deference.

CVS Health Buys AmerisourceBergen’s US Bioservices specialty pharmacy

ICYMI, AmerisourceBergen (ABC) quietly sold its US Bioservices pharmacy to CVS Health. The transaction illustrates how vertical integration has made it harder to be an unaligned specialty pharmacy, as I noted in The State of Specialty Pharmacy 2022.

There was no public announcement of this transaction. However, ABC dropped a major hint on page 67 of its 2021 10-K filing:

There was no public announcement of this transaction. However, ABC dropped a major hint on page 67 of its 2021 10-K filing:

"Assets and Liabilities Held for SaleThanks to intrepid analyst Eric Percher of Nephron Research for pushing the companies to disclose the completion of the transaction.

The Company recently entered into agreements to sell two of its non-core subsidiaries. In connection with entering into these agreements, the Company concluded that both disposal groups met the held for sale criteria and classified their assets and liabilities as held for sale as of September 30, 2021. One disposal group is included within the Pharmaceutical Distribution Services reportable segment and the other disposal group is included within Other.

The Company expects to complete the sales of the disposal groups within twelve months of September 30, 2021. In connection with the held for sale classification, the Company recorded an $11.3 million loss on the remeasurement of the disposal group held for sale in the Pharmaceutical Distribution Services segment to fair value less cost to sell in Impairment of Assets on its Consolidated Statement of Operations for the fiscal year ended September 30, 2021.”

Hospital-Administered Cancer Therapy Prices for Patients With Private Health Insurance, JAMA Internal Medicine

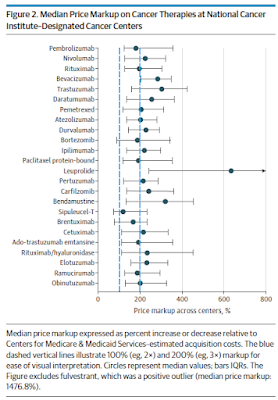

Here’s yet another study of hospital buy-and-bill profiteering. Cancer drug markups at 61 National Cancer Institute–designated cancer centers were +120% to +630%. Check out this summary of the startling markups:

To my surprise, the authors acknowledge economic realities that I have often discussed on Drug Channels:

[Click to Enlarge]

To my surprise, the authors acknowledge economic realities that I have often discussed on Drug Channels:

“Hospitals may earn greater revenue per unit from cancer therapies than the pharmaceutical companies that manufactured them…Although there are disagreements about whether the resource-intensive process of drug development justifies high prices set by pharmaceutical companies, hospitals that administer cancer drugs and inflate their prices do not create additional value.” (emphasis added)You don’t say!

Prior Authorizations For Everybody!, Dr. Glaucomflecken

Dr. Glaucomflecken takes aim at prior authorizations at Aetna. According to his comment on the video:

“This is an actual Aetna policy, and now other insurance companies are considering the same. It’s a shameless money grab. Literally every person on earth gets visually significant cataracts if they live long enough. There is no reason for restricting cataract surgery approval, other than greed.”

No comments:

Post a Comment