To complement that broader ranking, we rummaged around our DreamHouse to update our exclusive list of the top 15 pharmacies based on specialty drug dispensing revenues in 2022.

For 2022, pharmacy benefits managers (PBMs) and insurers expanded their dominance over specialty dispensing, though both hospitals and physician practices are growing their share of the market. The top three PBM-owned specialty pharmacies accounted for nearly two-thirds of prescription revenues from pharmacy-dispensed specialty drugs. As predicted last year, Walgreens’ specialty pharmacy business has collapsed, which led to a slightly less concentrated industry.

Read on for additional observations about hospitals, independent pharmacies, the dynamics that created this market structure, and why life in plastic is fantastic.

COME ON, BARBIE, LET'S GO PARTY

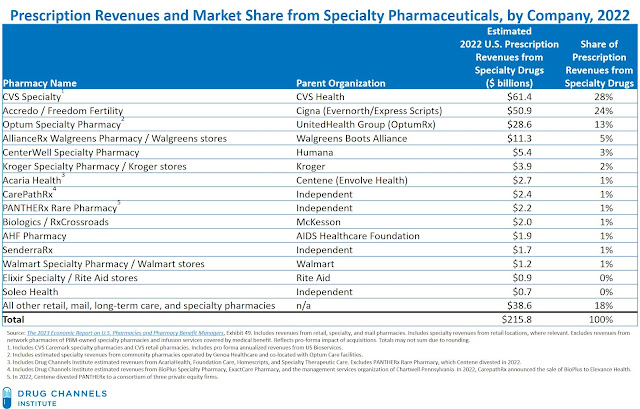

Drug Channels Institute (DCI) estimates that in 2022, retail, mail, long-term care, and specialty pharmacies dispensed about $216 billion in specialty pharmaceuticals prescriptions. That’s an increase of 12% from the 2021 figure.

The exhibit below—one of 241 in our 2023 Economic Report on U.S. Pharmacies and Pharmacy Benefit Managers—ranks the largest pharmacies based on estimated revenues from the dispensing of specialty pharmaceuticals. We discuss many of the individual companies listed below in the subsections of Section 3.3. in the full report.

[Click to Enlarge]

Here are five key reflections on the market share data shown above:

1. PBMs still dominate.

For 2022, the top three companies—CVS Health, Cigna, and UnitedHealth Group—accounted for nearly two-thirds of prescription revenues from pharmacy-dispensed specialty drugs. These businesses are all owned by vertically integrated organizations that also own a PBM. The specialty pharmacy business for all three companies experienced double-digit growth for 2022.

2. Manufacturer and payer strategies have consolidated specialty market share.

The concentration of specialty dispensing revenues results largely from strategies that plan sponsors and manufacturers use to narrow specialty drug channels. This has shifted dispensing to the largest specialty pharmacies owned by vertically integrated organizations.

As we document in Profiling Manufacturers’ Limited and Exclusive Pharmacy Networks for Specialty Drugs, the specialty pharmacies owned by the two largest PBMs—CVS Health and Express Scripts—had access to more than half of the specialty drugs in limited networks.

What’s more, the share of large employers with a restricted pharmacy network for specialty drugs has grown, from 36% of employers in 2011 to 68% in 2020. For 2021, employers reported reduced their use of restricted specialty pharmacy networks with one specialty pharmacy, likely due to the COVID-19 pandemic. For 2022, the use of exclusive specialty pharmacy networks rebounded, but remained below its pre-pandemic level.

As we document in Profiling Manufacturers’ Limited and Exclusive Pharmacy Networks for Specialty Drugs, the specialty pharmacies owned by the two largest PBMs—CVS Health and Express Scripts—had access to more than half of the specialty drugs in limited networks.

What’s more, the share of large employers with a restricted pharmacy network for specialty drugs has grown, from 36% of employers in 2011 to 68% in 2020. For 2021, employers reported reduced their use of restricted specialty pharmacy networks with one specialty pharmacy, likely due to the COVID-19 pandemic. For 2022, the use of exclusive specialty pharmacy networks rebounded, but remained below its pre-pandemic level.

3. Walgreens’ specialty revenues have plummeted.

We estimate that specialty dispensing revenues at Walgreens declined by more than 40% in 2022. The revenue figure for Walgreens includes AllianceRx Walgreens Pharmacy (ARxWP), Walgreens’ specialty pharmacy locations inside hospitals, Walgreens’ retail specialty pharmacies, and specialty drugs dispensed within Walgreens retail drugstores.

The ARxWP business suffered significant revenue and customer losses during 2022, due largely to the dissolution of the company’s joint venture with Prime Therapeutics. Most of ARxWP’s lost business shifted to Express Scripts. These lost clients reduced AllianceRx Walgreens Prime revenues by an estimated $9 billion in 2022. We summarize this sad tale in Section 3.3.4. of our new report.

4. Providers continue to gain traction.

Hospitals and health systems are among the fastest-growing participants in the specialty pharmacy market. They now account for almost one-quarter of total accredited specialty pharmacies. This category has expanded quickly, as hospitals and health systems have opened internal pharmacies.

Changes in manufacturers’ 340B contract pharmacy policies have accelerated hospitals’ investments in in-house specialty pharmacy operations. Many self-insured health systems require their employees—the plan’s beneficiaries—to use the specialty pharmacy that the health system owns and operates. (See Fresh Evidence: How Health Systems Steer Prescriptions to Their Own Specialty Pharmacies.)

Changes in manufacturers’ 340B contract pharmacy policies have accelerated hospitals’ investments in in-house specialty pharmacy operations. Many self-insured health systems require their employees—the plan’s beneficiaries—to use the specialty pharmacy that the health system owns and operates. (See Fresh Evidence: How Health Systems Steer Prescriptions to Their Own Specialty Pharmacies.)

5. Independent specialty pharmacies remain viable.

The list above includes four independent specialty pharmacies. Independent pharmacies remain the largest category of accredited specialty pharmacies, but account for a minority of total specialty dispensing revenues. The industry environment remains difficult for independent specialty pharmacies. Fewer new specialty pharmacies have started up, and the largest independent companies have been acquired. The remaining independent specialty pharmacies are larger and generally well-capitalized.

Honorable mention goes to Hy-Vee stores and its Amber Pharmacy. We rank its specialty revenues as #16 for 2022, so it just missed our list.

Honorable mention goes to Hy-Vee stores and its Amber Pharmacy. We rank its specialty revenues as #16 for 2022, so it just missed our list.

For more, see Chapter 3 of our pharmacy/PBM report, which provides a comprehensive analysis of the specialty pharmacy market, as well as detailed profiles of the largest specialty pharmacies shown above. Pinkalicious!

NOTES FOR KENS

- Most companies do not report prescription revenues from specialty drugs. DCI has therefore used various methods and primary sources to estimate the data. In some cases, the companies provided us with revenue figures.

- As noted in the exhibit’s footnotes, DCI has made various adjustments to account for the pro forma impact of mergers and acquisitions as well as certain client transitions among the largest PBMs. Pro forma revenues are computed based on the year in which an acquisition was completed. Year-over-year growth rates were also computed based on the prior year’s pro forma revenues.

- Revenues in the “All other retail, mail, long-term care, and specialty pharmacies” category come from the many pharmacies now competing to dispense these expensive therapies. As we discuss in Chapter 3 of the full report, the specialty market’s growth continues to draw many companies into the business of dispensing specialty drugs.

- The market size figure excludes estimated revenues from provider-administered specialty drugs billed under a patient’s medical benefit.

- Note that specialty drugs’ share of plan sponsors’ pharmacy benefit costs is higher than their share of prescription revenues, because formulary rebates do not impact prescription dispensing revenues.

- Use the Barbie Selfie Generator to create a personalized image like the one at the top of this post.

No comments:

Post a Comment