One update to the list below: CVS Health has quietly purchased AmerisourceBergen's US Bioservices specialty pharmacy.

Click here to see the original post from May 2022.

In Drug Channels Institute’s list of the top 15 pharmacies of 2021, we show that central-fill, mail pharmacies operated by large PBMs and health insurers have displaced retail chains as the largest prescription drug dispensers by revenues.

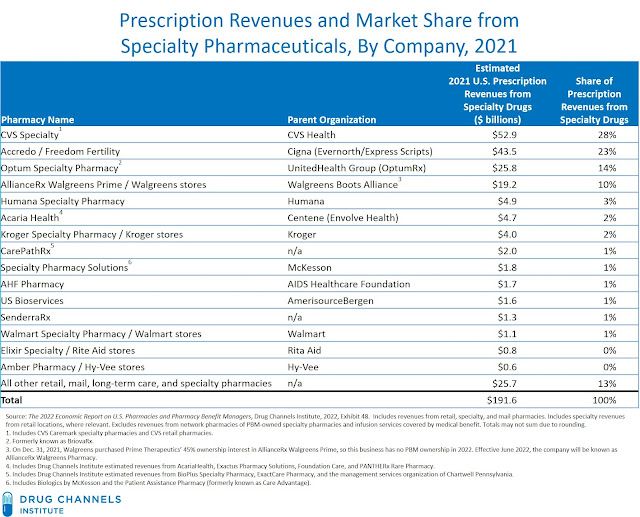

To complement that broader ranking, we present below our exclusive and updated list of the top 15 pharmacies based on specialty drug dispensing revenues in 2021. You will see that PBMs and insurers retained their dominance over specialty dispensing.

But as I explain below, 2022 will be a year of transition. Significant volume will shift to the larger players, as Centene plots its exit, Walgreens’ specialty pharmacy business collapses, and manufacturers’ 340B contract pharmacy restrictions continue.

This week, I’m attending Asembia’s Specialty Pharmacy Summit. In a future article, I’ll violate Vegas code and tell you what happened.

DCI’s TOP 15 FOR ‘21

Drug Channels Institute (DCI) estimates that in 2021, retail, mail, long-term care, and specialty pharmacies dispensed about $192 billion in specialty pharmaceuticals prescriptions. That’s an increase of 9% from the 2020 figure.

The exhibit below—one of 216 in our 2022 Economic Report on U.S. Pharmacies and Pharmacy Benefit Managers—ranks the largest pharmacies based on estimated revenues from the dispensing of specialty pharmaceuticals.

[Click to Enlarge]

Here are four key reflections on the market share data shown above:

- For 2021, the top four specialty pharmacies accounted for three-quarters of total prescription revenues from pharmacy-dispensed specialty drugs. The top four companies’ share decreased in 2021, due to declining revenue at AllianceRx Walgreens Prime. (See below.) The top three specialty pharmacies are each owned by one of the largest PBMs.

- The concentration of specialty dispensing revenues results largely from strategies that plan sponsors and manufacturers use to narrow specialty drug channels. This has shifted dispensing to the largest specialty pharmacies owned by vertically integrated organizations. (See Section 3.4.1. and 7.3. of >our pharmacy/PBM report.) For 2021, employers reported reducing their use of restricted specialty networks. It’s unclear if this reflects a long-term change in benefit strategy or was simply a reaction to the COVID-19 pandemic.

- The list above includes a number of smaller specialty pharmacies, which have faced an industry shakeout. Fewer new ones have started up, while the largest independent companies have been acquired. The remaining smaller specialty pharmacies are larger and generally well-capitalized. Some are independent companies, while others are owned by such channel participants as retail chains and wholesalers.

- Hospitals and health systems are among the fastest-growing participants in the specialty pharmacy market. As far as we can tell, the largest hospital and health system specialty pharmacies are not yet big enough to make our list. But some seem to be getting close.

For 2022, three major developments will likely shift even more market share to the largest players:

1) The Centene Exit.

Centene has become one of the largest specialty pharmacy operators. The company acquired AcariaHealth in 2013. Its subsequent specialty pharmacy acquisitions include Foundation Care, WellCare’s Exactus Pharmacy Solutions specialty pharmacy, and PANTHERx Rare Pharmacy, which had been the largest independent pharmacy.

Its leadership appears to have been short lived. During 2022, the company expects to outsource its $35 billion PBM operation to an external partner. I presume this will also include divesting its specialty pharmacies. Centene is rumored to already be shopping PANTHERx.

Its leadership appears to have been short lived. During 2022, the company expects to outsource its $35 billion PBM operation to an external partner. I presume this will also include divesting its specialty pharmacies. Centene is rumored to already be shopping PANTHERx.

2) The Walgreens Wind-Down.

Walgreens’ specialty pharmacy business declined significantly in 2021, with more pain to come in 2022. Its losses will be gains for Cigna’s Express Scripts business and CVS Health’s Caremark business.

In 2017, Walgreens Boots Alliance (WBA) and Prime Therapeutics formed AllianceRx Walgreens Prime and made it the exclusive mail and specialty pharmacy for Prime Therapeutics’ PBM beneficiaries. Since January 2021, however, Prime’s Blue Cross and Blue Shield plans have had the option to use Express Scripts’ pharmacies or stay with the AllianceRx Walgreens Prime pharmacy.

I guess this wasn’t a tough choice for the plans, because it appears that many (most?) of Prime’s plan sponsor clients have shifted their specialty pharmacy business to Express Scripts. Walgreens has publicly projected that these clients will reduce AllianceRx Walgreens Prime revenues’ by at least $8 billion during 2021 and 2022.

It gets worse. Effective January 2022, the specialty portion of the Federal Employee Program (FEP) mail and pharmacy services contract transitioned from Prime Therapeutics back to CVS Health’s Caremark business. This change will cost Walgreens a few billion more in lost revenues.

On Dec. 31, 2021, Walgreens Boots Alliance bought out Prime Therapeutics’ minority ownership, leaving WBA saddled with a specialty pharmacy business without any PBM ownership. Effective June 2022, the business will be known as AllianceRx Walgreens Pharmacy (AWP?).

P.S. BTW, Express Scripts’ specialty pharmacy business will also be getting a boost from its recently announced partnership with Kaiser Permanente.

In 2017, Walgreens Boots Alliance (WBA) and Prime Therapeutics formed AllianceRx Walgreens Prime and made it the exclusive mail and specialty pharmacy for Prime Therapeutics’ PBM beneficiaries. Since January 2021, however, Prime’s Blue Cross and Blue Shield plans have had the option to use Express Scripts’ pharmacies or stay with the AllianceRx Walgreens Prime pharmacy.

I guess this wasn’t a tough choice for the plans, because it appears that many (most?) of Prime’s plan sponsor clients have shifted their specialty pharmacy business to Express Scripts. Walgreens has publicly projected that these clients will reduce AllianceRx Walgreens Prime revenues’ by at least $8 billion during 2021 and 2022.

It gets worse. Effective January 2022, the specialty portion of the Federal Employee Program (FEP) mail and pharmacy services contract transitioned from Prime Therapeutics back to CVS Health’s Caremark business. This change will cost Walgreens a few billion more in lost revenues.

On Dec. 31, 2021, Walgreens Boots Alliance bought out Prime Therapeutics’ minority ownership, leaving WBA saddled with a specialty pharmacy business without any PBM ownership. Effective June 2022, the business will be known as AllianceRx Walgreens Pharmacy (AWP?).

P.S. BTW, Express Scripts’ specialty pharmacy business will also be getting a boost from its recently announced partnership with Kaiser Permanente.

3) The 340B Reset.

Sixteen manufacturers have announced controversial new policies related to covered entities’ contract pharmacies in the 340B Drug Pricing Program. Ironically, these actions may increase revenues flowing through the largest PBMs’ specialty pharmacies, albeit at lower profits for these pharmacies.

Specific policies vary by company, but most manufacturers require a covered entity to use an on-site pharmacy and/or designate a single, external contract pharmacy.

As expected, such policies are encouraging hospitals to invest in their in-house specialty pharmacy operations. And paralleling the actions of PBM-owned specialty pharmacies, many self-insured health systems require their employees—the plan’s beneficiaries—to use the specialty pharmacy that health system owns and operates. See Fresh Evidence: How Health Systems Steer Prescriptions to Their Own Specialty Pharmacies.

But when forced to choose a single partner among the many pharmacies in their 340B network, hospitals are generally picking a large, PBM-owned pharmacy with access to specialty drugs in limited dispensing networks. This will further concentrate specialty revenues—and at least for now, will outstrip the growth of hospitals’ specialty pharmacies.

As I noted in last week’s news roundup, 340B-eligible revenues declined for manufacturers that implemented contract pharmacy restrictions. This reduces PBMs’ profits, although it’s not clear how much of the 340B spread is retained by PBMs vs. being passed along to plan sponsors.

Specific policies vary by company, but most manufacturers require a covered entity to use an on-site pharmacy and/or designate a single, external contract pharmacy.

As expected, such policies are encouraging hospitals to invest in their in-house specialty pharmacy operations. And paralleling the actions of PBM-owned specialty pharmacies, many self-insured health systems require their employees—the plan’s beneficiaries—to use the specialty pharmacy that health system owns and operates. See Fresh Evidence: How Health Systems Steer Prescriptions to Their Own Specialty Pharmacies.

But when forced to choose a single partner among the many pharmacies in their 340B network, hospitals are generally picking a large, PBM-owned pharmacy with access to specialty drugs in limited dispensing networks. This will further concentrate specialty revenues—and at least for now, will outstrip the growth of hospitals’ specialty pharmacies.

As I noted in last week’s news roundup, 340B-eligible revenues declined for manufacturers that implemented contract pharmacy restrictions. This reduces PBMs’ profits, although it’s not clear how much of the 340B spread is retained by PBMs vs. being passed along to plan sponsors.

For more, see Chapter 3 of our pharmacy/PBM report, which provides a comprehensive analysis of the specialty pharmacy market, as well as detailed profiles of the largest specialty pharmacies shown above.

NOTES FOR NERDS

- Most companies do not report prescription revenues from specialty drugs. DCI has therefore used various methods and primary sources to estimate the data. In some cases, the companies provided use with revenue figures.

- As noted in the exhibit’s footnotes, DCI has made various adjustments to account for the pro forma impact of mergers and acquisitions as well as certain client transitions among the largest PBMs. Pro forma revenues are computed based on the year in which an acquisition was completed. Year-over-year growth rates were also computed based on the prior year’s pro forma revenues.

- The market size figure excludes estimated revenues from provider-administered specialty drugs billed under a patient’s medical benefit.

- Note that specialty drugs’ share of plan sponsors’ pharmacy benefit costs is higher than their share of prescription revenues, because formulary rebates do not impact prescription dispensing revenues.

No comments:

Post a Comment