Diplomat’s management pinned the blame squarely on direct and indirect remuneration (DIR) fees paid to Medicare Part D plans. Below, I highlight the key concerns that Diplomat outlined. By reader request, I also provide a primer on DIR fees, whose impact was apparently unexpected by investors.

The rhetoric and controversy over DIR fees once again pits pharmacies against PBMs. Who will take the DIRect hit?

THE QUARTERLY RESULTS AND THE SPIN

As always, I encourage you to read the original source material for yourself. Here are links to the information about Diplomat’s third quarter earnings:

As with my analysis of McKesson’s earnings, I suggest you read the entire transcript so you can see Diplomat CEO and Chairman Phil Hagerman’s strong words about pharmacy benefit managers (PBMs) and their application of DIR fees.

Here are highlights from Hagerman’s opening remarks:

“While DIR fees are not new in terms of their existence, the rates, methodology, timing and transparency associated with them have all changed dramatically in 2016 and they are now impacting the entire specialty pharmacy industry. Because the fees are performance-based, some PBMs claim that the fees cannot be calculated at the time of adjudication. Those PBMs contend that it is only after the fact and sometimes months or quarters later that these fees can be accurately calculated and collected.”The bulk of the call was a spirited discussion among Hagerman, CFO Sean Whalen, and the sell-side equity analysts who cover Diplomat. It’s worthwhile reading.

“Diplomat and the entire specialty pharmacy industry do not agree with how the practice has evolved and the broad expansion that has taken place in 2016. We don't feel that the way some of the PBMs are calculating these fees meet the goals, outcomes or spirit of CMS's intentions.”

“[T]here was little to no transparency on the changes that were implemented in 2016 and we specialty pharmacies were unaware of the potential magnitude of these changes until we received our first 2016 fee statements this quarter. The fact that the DIR fees are retroactive to January 1st only makes the impact of the third quarter seem more disproportionate.”

A PRIMER ON DIR FEES

Many people don’t understand or even know about DIR fees. Here’s my quick primer to get you up to speed. Some of this material appears in Sections 7.2.4. and 7.2.5. of our 2016 Economic Report on Retail, Mail, and Specialty Pharmacies.

According to federal regulations, preferred pharmacies in Part D must offer “covered Part D drugs at negotiated prices to Part D enrollees at lower levels of cost-sharing than apply at a non-preferred pharmacy under its pharmacy network contract.” (See Code of Federal Regulations, Sec. 423.100.)

Plans use narrow pharmacy networks as a way of reducing pharmacy benefit spending, so pharmacies’ willingness to accept lower payments have driven network participation decisions. Medicare Part D plans rely on post-point-of-sale (POS) price concessions paid by pharmacies to the Part D plan sponsor. These price concessions, which are collected from pharmacies after claim adjudication, are considered direct and indirect remuneration (DIR) under federal requirements. Since these are price concessions, Medicare Part D plans provide details about these transactions in an annual DIR report to CMS.

DIR is a broad term that relates to the net amounts actually paid by a part D sponsor. It is not limited to amounts paid by pharmacies to plan sponsors. Here are the relevant definitions from Section 423.308 of the Code of Federal Regulations:

“Actually paid means that the costs must be actually incurred by the Part D sponsor and must be net of any direct or indirect remuneration (including discounts, charge backs or rebates, cash discounts, free goods contingent on a purchase agreement, up-front payments, coupons, goods in kind, free or reduced-price services, grants, or other price concessions or similar benefits offered to some or all purchasers) from any source (including manufacturers, pharmacies, enrollees, or any other person) that would serve to decrease the costs incurred under the Part D plan.Whew!

Direct and indirect remuneration includes discounts, chargebacks or rebates, cash discounts, free goods contingent on a purchase agreement, upfront payments, coupons, goods in kind, free or reduced-price services, grants, or other price concessions or similar benefits from manufacturers, pharmacies or similar entities obtained by an intermediary contracting organization with which the Part D plan sponsor has contracted, regardless of whether the intermediary contracting organization retains all or a portion of the direct and indirect remuneration or passes the entire direct and indirect remuneration to the Part D plan sponsor and regardless of the terms of the contract between the plan sponsor and the intermediary contracting organization.”

DIR fees are part of confidential contracts, so unfortunately there are very limited public data that I can share on Drug Channels.

Some plans have flat per-prescription DIR fees that range from $2.00 to $7.00 per prescription claim. Other plans require DIR fees that are a percentage of a prescription's ingredient cost. These amounts are typically 3% to 5% for a brand-name prescription. I’ve been told that at least one major open network Part D plan levies DIR fees on all prescriptions, not just those filled at preferred pharmacies.

Since average per-prescription gross profits at a retail pharmacy are less than $15, even flat DIR fees imply a significant reduction in profits for the participating pharmacies. A pharmacy’s gross margins on brand-name prescriptions average 4% to 7%, so the percentage-based fees can also significantly reduce profits. For comparison, Diplomat’s reported gross margin ranged from 6.6% to 8.0% during the first three quarters of 2016.

Pharmacies can dodge most DIR fees by opting out of preferred networks. As I show in Walgreens Plays to Win: Our Exclusive Analysis of 2017's Part D Preferred Pharmacy Networks, some chains have already pulled back from preferred network participation.

PERFORMANCE-BASED DIR FEES

DIR fees in preferred networks were initially computed on a per-prescription basis without regard to a pharmacy’s performance. Plans are now starting to consider various measures of pharmacy quality in network design.

For 2016, the DIR fees for many Part D plans are based on such performance criteria as generic dispensing rates and adherence metrics related to star ratings. Now that preferred networks dominate the Medicare Part D program, pharmacy performance is becoming a key criterion for inclusion as a preferred pharmacy in a plan’s network.

For example, CMS incorporates an adherence metric in the ratings for Medicare Advantage and Prescription Drug Plans. Each plan is given between one and five stars, with a five-star rating considered “excellent.” CMS measures adherence as the percentage of Medicare Part D beneficiaries whose prescription claims indicate that patients have sufficient medication on hand to cover 80% or more of the period during which they are supposed to be taking the medication. (CMS does not assign star ratings to pharmacies.)

Pharmacies can influence such metrics as the Proportion of Days Covered, which measures adherence for oral diabetes, statins, and hypertension medications. Patients who receive appropriate prescription refills by the plan’s network pharmacies will have higher adherence, and in turn, the plan will receive higher ratings.

Consequently, many Part D plans now incorporate quantitative performance metrics into the computation of the DIR fee. For example, a pharmacy’s DIR fee could be reduced if the pharmacy: achieved better performance on the three adherence metrics used in the plan’s star rating, had better compliance with the plan’s formulary, dispensed a greater share of generic prescriptions, and/or dispensed more 90-day prescriptions. The specific criteria and thresholds are different for every plan and not publicly available.

Note that these metrics are typically not relevant to a specialty pharmacy, which does not dispense the traditional drug classes with Part D adherence measures and dispenses few generic prescriptions. Hagerman emphasized this point in response to a question about DIR fees:

“What happened in early 2016 is there were some dramatic and broad changes in the interpretation by some of the PBMs. All of a sudden, we started seeing the reconciliation for changes in DIR while specialty pharmacy was not getting paid anything extra or no monies came our way that should be taken away. The rules and the guidance of how these effect retail pharmacies and retail categories like diabetes have no effect on specialty pharmacy. There are no generic drugs, there's no substitution, there are very few therapeutic opportunities. So, the rules frankly don't make sense in specialty pharmacy.”HERE WE WERE

Performance-based DIR fees must be computed retroactively. For example, the period from January through April could be used to measure a pharmacy’s activities. The plan would analyze the data over two months (May and June), and then assess the DIR fees in July. Consequently, pharmacies would feel the financial impact in the third calendar quarter.

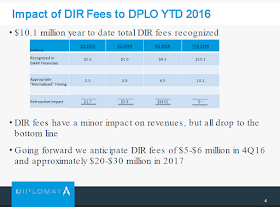

Diplomat has provided some supplemental details that support this timing. The slide below shows that $8.5 million of its DIR fees were paid in the third quarter of 2016. If these fees had been allocated to the appropriate prescriptions at the time of dispensing, the fees would have been spread out over the first three quarters.

[Click to Enlarge]

Are pharmacies flying blind? I’m not sure. There are technology tools that purportedly allow pharmacy owners to view DIR fee computations and estimate their financial impact. A pharmacy could therefore accrue for these liabilities.

Check out iMedicare FAQ: DIR Fees, a short video from iMedicare explaining how a pharmacy owner could evaluate and anticipate its DIR fees. (I’m not endorsing or opining on iMedicare’s solution. I’m simply pointing out that such tools exist from at least one vendor.)

Elevate Provider Network, the pharmacy services administration organization (PSAO) owned by AmerisourceBergen, told me that it is “actively working on a technological solution to assist customers view DIR fees and estimate the financial impact.” According to Elevate, this new tool will be available to its members in 2017.

FAIR OR DIR-TY?

As Hagerman’s comments illustrate, the rhetoric and emotion around DIR fees has become incredibly heated.

The National Community Pharmacists Association (NCPA), which lobbies for pharmacy owners, hates DIR fees:

“Misleading and confusing fees imposed by drug plan middlemen distort prescription drug prices for everyone. These clawbacks, or ‘DIR fees’, also threaten independent community pharmacies.”However, the Pharmaceutical Care Management Association (PCMA), which lobbies for PBMs, defend these fees:

“Direct and Indirect Remuneration (DIR) is a form of performance-based payment used by PBMs to promote value and quality and helps keep premiums down for Medicare beneficiaries.”Diplomat’s earnings highlighted the topic for investors. Add DIR fees to the very long list of health care issues that the new Congress needs to tackle in January.

No comments:

Post a Comment