Rather than announce multiple biosimilars for its pharmacy benefit manager (PBM) formulary, the company will instead launch Cordavis, a new subsidiary that will market a private label, low-list-price version of Sandoz’ Hyrimoz. Here’s the press release: CVS Health Launches Cordavis.

Below, I highlight how CVS Health could profit from this strategy and outline crucial unanswered questions about this latest vertical integration move. Let’s see if plan sponsors, patients, and legislators will pay attention to the man behind the curtain.

THE WONDERFUL WIZARD OF SANDOZ

Cordavis is a new CVS Health subsidiary that will “work directly with manufacturers to commercialize and/or co-produce biosimilar products.”

Up first is a private label version of Sandoz’ Hyrimoz with a list price “more than 80% lower than the current list price of Humira.” Reportedly, Cordavis has committed to minimum purchasing volumes from Sandoz, which will sell the product to Cordavis at a fixed price.

By contrast, CVS Health’s two large PBM peers—Express Scripts and OptumRx—have each selected five biosimilars for their primary formularies. Both PBMs included at least one biosimilar with a list price far below Humira’s list price. See Four Crucial Questions about the Humira Biosimilar Price War.

One more notable point: Sandoz went over the rainbow and launched both high-list and low-list versions of its Humira biosimilar. Its unbranded adalimumab-adaz already has a list price that is 81% below Humira’s list price.

We here at Drug Channels salute CVS Health for supporting a biosimilar with a lower list price. However, I doubt the Wicked Gross-to-Net Bubble Witch is dead.

FOLLOW THE GREEN BRICK ROAD

Wall Street analysts applauded CVS Health’s move. And why not? The Cordavis strategy offers CVS Health multiple, new ways to improve its profitability. These could include:

- Absorbing a portion of a biosimilar manufacturer’s profit margin

- Gaining incremental negotiating power against manufacturers of both reference products and biosimilars

- Generating superior insight into biosimilar manufacturing costs

- Establishing proprietary acquisition cost benchmarks that enable higher reimbursement from plan sponsors

- Shifting profits from formulary rebates paid to its PBM business to discounts earned by its specialty pharmacy

- Locking in a preferred source of supply

NO PLACE LIKE HOME?

There’s a notable similarity between CVS Health and one of its PBM peers.

CVS Health established Cordavis in Dublin, Ireland. That’s unlike the location of CVS Health’s Zinc rebate purchasing organization. See Five (or Maybe Six?) Reasons that the Largest PBMs Operate Group Purchasing Organizations.

This offshore approach is consistent with Quallent Pharmaceuticals, the private label business owned by Cigna’s Evernorth business.

Quallent was established in 2021 and currently offers 23 private-label generic drugs. Most of these products appear to be readily available from multiple generic manufacturers as well as pharmaceutical wholesalers’ private label generic programs.

Quallent is based in the Cayman Islands because…well, I’m not really sure. Cigna declined to offer its perspective. Perhaps the Caribbean has secretly been the world’s hub for generic drugs? Maybe there are other reasons. I’ve got a feeling they’re not in Kansas anymore.

OFF TO SEE THE WIZARD

There are some crucial unanswered questions about CVS Health’s Humira strategy:

- Will the new private label product be the exclusive biosimilar on one or more of CVS Caremark’s formularies, or merely be one of multiple biosimilars?

- Will new-to-therapy patients have to step through the CVS Health private label before gaining access to Humira and/or other biosimilars?

- What is the pricing advantage of the CVS Health version compared with Sandoz’ current unbranded Humira biosimilar? In other words, what’s the difference between “more than 80% lower” and 81% lower?

- How much of any incremental savings will be shared with CVS Health's plan sponsor clients—and with patients?

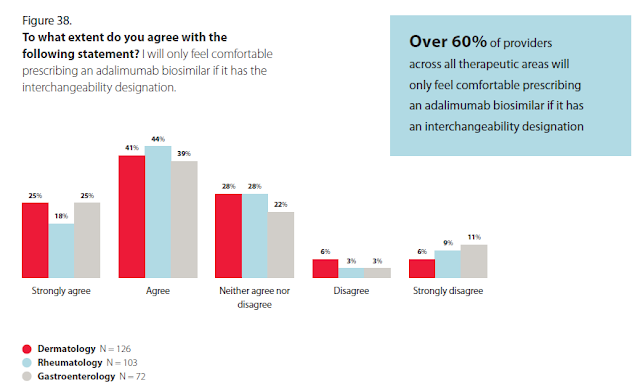

- Why is CVS Health betting on a non-interchangeable biosimilar?

[Click to Enlarge]

COWARDLY LION

So far, CVS Health has provided few substantive details about Cordavis—although I'm sure the Federal Trade Commission has some questions. Perhaps CVS should ask the wizard for some courage.

CORRECTION: An earlier version of this article incorrectly stated that Cordavis was based in the United States.

No comments:

Post a Comment