In this issue:

- Mark Cuban explains his anti-PBM strategy

- What physicians think about Humira biosimilars

- States go after PBMs

- HHS is confused about 340B transparency

P.S. Join my nearly 38,000 LinkedIn followers for daily links to neat stuff. You can also find my daily posts at @DrugChannels on Twitter, where I have nearly 16,000 followers.

Interview with Mark Cuban, AAM Annual Meeting 2023

At the recent Association for Accessible Medicine (AAM) Annual Meeting, Mark Cuban sat down with Christine Baeder, SVP & Chief Operating Officer, U.S. Generics and Biosimilars at Teva Pharmaceuticals.

The entire interview is worth your time. I especially enjoyed hearing Mr. Cuban describe his views on why the U.S. drug channel and the role of vertically integrated insurer/PBM/pharmacy companies. (Video clip below starts at 5:14. Click here if you can’t see video.)

Click here to read the transcript.

This topic is so important that I will devote the first webinar of the Drug Channels 2023 Video Webinar Series to the implications of patient-paid prescriptions on PBMs and the drug channel. Details next week!

The entire interview is worth your time. I especially enjoyed hearing Mr. Cuban describe his views on why the U.S. drug channel and the role of vertically integrated insurer/PBM/pharmacy companies. (Video clip below starts at 5:14. Click here if you can’t see video.)

Click here to read the transcript.

This topic is so important that I will devote the first webinar of the Drug Channels 2023 Video Webinar Series to the implications of patient-paid prescriptions on PBMs and the drug channel. Details next week!

2023 Biosimilars Report, Cardinal Health

Cardinal Health just released the full version of its excellent—and free—2023 Biosimilars Report. Drug Channels salutes Cardinal for sponsoring this valuable resource.

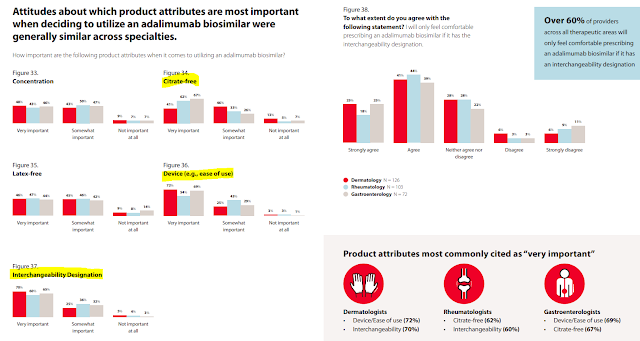

This report has loads of neat data on how physicians view biosimilars. Consider the chart below from pages 40 to 41. As you can see, the majority of physicians will only feel comfortable prescribing a Humira biosimilar that has an interchangeability designation. They also rank having a citrate-free version and an easy-to-use device as important. Notably, the views vary by specialty.

Unfortunately, the survey neglected to ask whether physicians prefer Humira biosimilars to have higher or lower list prices. If that observation confused you, see The Warped Incentives Behind Amgen’s Humira Biosimilar Pricing–And What We Can Learn from Semglee and Repatha.

This report has loads of neat data on how physicians view biosimilars. Consider the chart below from pages 40 to 41. As you can see, the majority of physicians will only feel comfortable prescribing a Humira biosimilar that has an interchangeability designation. They also rank having a citrate-free version and an easy-to-use device as important. Notably, the views vary by specialty.

[Click to Enlarge]

Unfortunately, the survey neglected to ask whether physicians prefer Humira biosimilars to have higher or lower list prices. If that observation confused you, see The Warped Incentives Behind Amgen’s Humira Biosimilar Pricing–And What We Can Learn from Semglee and Repatha.

States, not Federal Government, Are Moving to Tighten Regulation of PBMs, Formulary Watch

After spending 2022 going after manufacturers, Congress is finally turning its attention to PBMs. Consider the recent PBM-bashing session held by the Senate Committee on Commerce, Science and Transportation.

Meanwhile, there has been a spike in state legislation targeting various aspects of the U.S. drug channel and its participants, as the article linked above shows. From 2017 through 2022, forty-six states have passed 133 laws focused fully or partially on PBMs.

Some of these laws actually target PBM oversight, although enforcement seems weak. But most of the PBM-related state laws focus on topics that are most relevant to smaller pharmacies, such MAC lists, post-adjudication fees, and anti-mandatory mail order.

I’m not yet convinced that these state laws can or will guide federal legislation, but it’s still worth tracking. For more on state legislation of the drug channel, see Section 12.3.3. of our forthcoming 2023 Economic Report on U.S. Pharmacies and Pharmacy Benefit Managers.

Meanwhile, there has been a spike in state legislation targeting various aspects of the U.S. drug channel and its participants, as the article linked above shows. From 2017 through 2022, forty-six states have passed 133 laws focused fully or partially on PBMs.

Some of these laws actually target PBM oversight, although enforcement seems weak. But most of the PBM-related state laws focus on topics that are most relevant to smaller pharmacies, such MAC lists, post-adjudication fees, and anti-mandatory mail order.

I’m not yet convinced that these state laws can or will guide federal legislation, but it’s still worth tracking. For more on state legislation of the drug channel, see Section 12.3.3. of our forthcoming 2023 Economic Report on U.S. Pharmacies and Pharmacy Benefit Managers.

Medicare Part D Drug Inflation Rebates Paid by Manufacturers: Initial Memorandum, Implementation of Section 1860D-14B of Social Security Act, and Solicitation of Comments, U.S. Department of Health and Human Services

Under the Inflation Reduction Act of 2022 (IRA), manufacturers will not be liable for the new mandatory inflation rebates on Medicare Part D prescriptions that were eligible for 340B Drug Pricing Program discounts.

This will be a big issue. Per Exhibit 2 of a nifty new IQVIA report, Medicare accounts for 40% of claims for 340B-eligible, patient-administered brand-name drugs.

In page 18 of the memo linked above, the U.S. Department of Health and Human Services (HHS) solicits public comments on solutions to identify 340B prescription claims paid by Medicare Part D.

Meanwhile, HHS is currently suing manufacturers that are using a technology solution to identify 340B prescription claims paid by Medicare Part D.

Alas, government bureaucracies are immune to irony...

This will be a big issue. Per Exhibit 2 of a nifty new IQVIA report, Medicare accounts for 40% of claims for 340B-eligible, patient-administered brand-name drugs.

In page 18 of the memo linked above, the U.S. Department of Health and Human Services (HHS) solicits public comments on solutions to identify 340B prescription claims paid by Medicare Part D.

Meanwhile, HHS is currently suing manufacturers that are using a technology solution to identify 340B prescription claims paid by Medicare Part D.

Alas, government bureaucracies are immune to irony...

Cancer Patient Harasses Poor Little Insurance Company Into Covering Bill, The Onion

Fact or fiction for UnitedHealthcare? You decide.

No comments:

Post a Comment