So before you launch your July 4 festivities and/or a civil war, Drug Channels humbly offers some data fireworks for our troubled nation:

- More evidence of slow growth in drug spending for 2021

- Fresh data on skyrocketing PBM formulary exclusions

- Employers still hoarding rebates

- Pharmacy pricing in the era of GoodRx

P.S. Join my nearly 29,000 LinkedIn followers for daily links to neat stuff. You can also find my daily posts at @DrugChannels on Twitter, where I have nearly 14,500 followers.

2021 Drug Trend Report, Navitus Health Solutions

More bad news for drug pricing flat earthers (#DPFE). According to Navitus Health Solutions’ latest trend report, drug spending at its plan sponsor clients grew by only 1.5% in 2021. What’s more, utilization—more people taking more prescriptions—remained the driving force behind spending growth.

Below are the headline data from its report. As you can see, net unit costs declined for both traditional and specialty prescriptions.

FYI, Navitus Health Solutions is a small PBM with about 7 million covered lives. It is owned by SSM Health, a not-for-profit health system, and the retailer Costco. Kudos to Navitus to continuing to publish its report.

Last year, I lamented the sad state of PBM drug trend reports. (See PBMs and Drug Spending in 2020: Data from CVS Health (sort of), Express Scripts, Navitus, and WellDyne.) Things have only gotten worse. For the first time in at least 15 years, Express Scripts has decided not to release an annual drug trend report. So much for transparency! I’ll share more in my forthcoming roundup of the available PBM reports.

Below are the headline data from its report. As you can see, net unit costs declined for both traditional and specialty prescriptions.

[Click to Enlarge]

FYI, Navitus Health Solutions is a small PBM with about 7 million covered lives. It is owned by SSM Health, a not-for-profit health system, and the retailer Costco. Kudos to Navitus to continuing to publish its report.

Last year, I lamented the sad state of PBM drug trend reports. (See PBMs and Drug Spending in 2020: Data from CVS Health (sort of), Express Scripts, Navitus, and WellDyne.) Things have only gotten worse. For the first time in at least 15 years, Express Scripts has decided not to release an annual drug trend report. So much for transparency! I’ll share more in my forthcoming roundup of the available PBM reports.

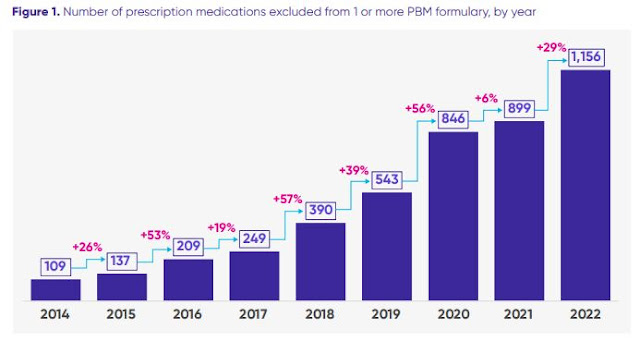

Skyrocketing growth in PBM formulary exclusions continues to raise concerns about patient access, Xcenda

I highly recommend this excellent Xcenda analysis of formularies at the largest three PBMs: CVS Caremark, Express Scripts, and OptumRx. Figure 1 from the report is reproduced below. It shows that the top PBMs excluded 1,156 unique prescription medications in 2022. Of this total, 548 (47%) were single-source drugs.

The report contains loads of useful data, including detailed analyses of exclusion in such therapeutic categories as insulin, oncology, and biosimilars. Xcenda also highlights the important real-world consequences for patients.

For my $0.02 on PBM formulary exclusion, see Five Takeaways from the Big Three PBMs’ 2022 Formulary Exclusions.

The report contains loads of useful data, including detailed analyses of exclusion in such therapeutic categories as insulin, oncology, and biosimilars. Xcenda also highlights the important real-world consequences for patients.

[Click to Enlarge]

For my $0.02 on PBM formulary exclusion, see Five Takeaways from the Big Three PBMs’ 2022 Formulary Exclusions.

2022 Milliman Medical Index, Milliman

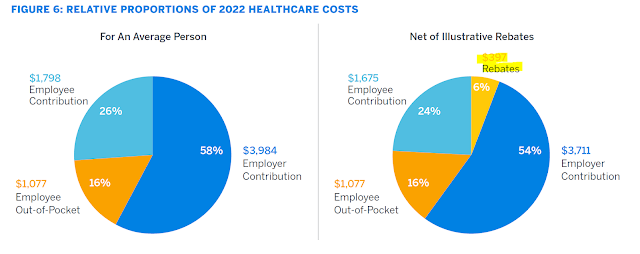

Ouch. Milliman estimates that pharmacy benefit drug rebates reduced total per-person healthcare costs by $397 (-6%). Unfortunately, employers kept about 70% of these rebate funds. Here’s the key chart from the report (with my highlighting):

In other words, employers used rebates to offset nondrug healthcare costs and reduce general premiums. They apparently chose not to offset the prices paid by patients whose prescriptions generated the rebate funds.

Consequently, people with chronic, complex diseases generate billions in rebate dollars, which are then used to lower the premiums of healthier beneficiaries. This is the reverse insurance problem. As former FDA commissioner Scott Gottlieb noted: “sick people aren’t supposed to be subsidizing the healthy.”

For an overview of challenges with our rebate system, see Section 9.3. of our 2022 Economic Report on U.S. Pharmacies and Pharmacy Benefit Managers.

[Click to Enlarge]

In other words, employers used rebates to offset nondrug healthcare costs and reduce general premiums. They apparently chose not to offset the prices paid by patients whose prescriptions generated the rebate funds.

Consequently, people with chronic, complex diseases generate billions in rebate dollars, which are then used to lower the premiums of healthier beneficiaries. This is the reverse insurance problem. As former FDA commissioner Scott Gottlieb noted: “sick people aren’t supposed to be subsidizing the healthy.”

For an overview of challenges with our rebate system, see Section 9.3. of our 2022 Economic Report on U.S. Pharmacies and Pharmacy Benefit Managers.

Obamacare Made Drug Benefits Worthless, Goodman Institute Health Blog

Devon Herrick, a health economist at the Goodman Institute for Public Policy research, shares some sensible questions about generic prescription pricing. (Just ignore his politically charged headline.)

Devon reflects on my recent GoodRx analysis (The GoodRx-Kroger Blowup: Spread Pricing, Pharmacy Margins, and the Future of Discount Cards), writing:

Devon reflects on my recent GoodRx analysis (The GoodRx-Kroger Blowup: Spread Pricing, Pharmacy Margins, and the Future of Discount Cards), writing:

“I find it hard to fathom that the sixth-largest U.S. pharmacy system cannot offer me a low cash price without going through two other entities. I find it even more outrageous that the pharmacy quoted my wife a cash price of $2,934.99 for a drug it was willing to sell for $87.31 while spitting that lower price with two other companies.”We all know why this happens. But that doesn’t make it sensible.

How to Get an MRI, Dr. Glaucomflecken

The brilliant Dr. Glaucomflecken does it again!

No comments:

Post a Comment