Alas, last week’s election exploded these projections. Today, I analyze CMS’s official pre-election insights about payment for outpatient prescriptions drugs in 2025. I then speculate on how these figures might change under the new administration, which wants to repeal and replace the Affordable Care Act (ACA). Based on the most well-known Republican proposals, I project a rebound in the employer-sponsored market compared with the CMS baseline projections.

But never forget a truism of the projection business: A good forecaster is not necessarily smarter than everyone else—he merely has his ignorance better organized.

DATA

I start with the July 2016 National Health Expenditure (NHE) data projections. These data assumed a business-as-usual scenario for healthcare spending.

The NHE shows the historical and projected payment sources for outpatient prescription drugs (share of dollars). U.S. drug spending in the NHE is roughly equivalent to total retail, mail, and specialty pharmacies’ prescription revenues minus manufacturer rebates to third-party payers. To learn more about these data, read the “Look into my crystal ball” section of Latest CMS Forecast Shows Big Drug Spending Growth Through 2025.

CMS projects drug spending projection by using unhelpful payer categories. See the footnotes in the charts for important information about my assumptions behind the spending categories in my charts.

IN THE YEAR 2025

Our first chart provides the baseline estimates of the 2025 payer mix, based on CMS’s July 2016 projections.

[Click to Enlarge]

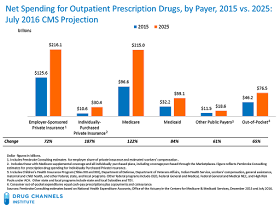

The next chart compares net spending in 2015 vs. 2025. Annual U.S. outpatient prescription drug expenditures were expected to grow by $292.9 billion (+91%), to $615.6 billion in 2025. Medicare’s spending in 2025 was projected to be roughly equal to employer-sponsored spending.

[Click to Enlarge]

BASELINE PROJECTIONS: VERY DOUBTFUL

Here are my observations on CMS’s pre-election views on how the prescription drug market would evolve.

- CMS projected that the government would crowd out other payers. CMS assumed that, as the U.S. population aged and healthcare reform was implemented, the employer-sponsored insurance market would shrink, while Medicare and Medicaid would grow. Consequently, public funds would pay for a greater share of outpatient prescription drug spending than would private funds. CMS projected that public funds would account for almost half (48%) of outpatient retail prescription spending in 2025, while employer-sponsored private health insurance’s share would drop to 35%.

- CMS believed that individually purchased insurance would grow. This category includes Medicare supplemental plans and coverage purchased through the federal and state marketplaces. CMS expected enrollment in individually purchased private insurance plans to grow, from 24.3 million people in 2015 to 30.7 million people by 2025. Note that the July 2016 forecast was lower than last year’s CMS projection, which had expected 30.7 million people by 2017.

- CMS expected that consumers would account for a decreasing share of drug spending. Consumer out-of-pocket funds—the sum of cash-paid prescriptions and consumer copayments—was projected to decline, from 14% in 2015 to 12% in 2025.

We now live in a world where the Affordable Care Act (ACA) will likely be repealed and replaced. One possible road map is the Restoring Americans’ Healthcare Freedom Reconciliation Act of 2015 (H.R. 3672), which President Obama vetoed earlier this year.

Something will replace the law, because Republicans don’t want millions of people to abruptly lose insurance. A useful starting point is Rep. Paul Ryan’s white paper A Better Way: Our Vision for a Confident America.

Here are my speculations on how an ACA repeal might affect the CMS projections.

- Employer-sponsored insurance will bounce back. In March, the Congressional Budget Office (CBO) estimated that because of the ACA, 4 million to 9 million fewer people each year will have employment-based coverage than would have had without the law. (source) Let’s assume that if the ACA is replaced, those people will retain employment-based coverage.

A post-election Wall Street Journal survey of economists projects faster economic growth under Trump’s plans to reduce taxes and invest in infrastructure. Such growth also bodes well for the employer market—more employees and potentially more generous benefits.

We can also say goodbye to the excise tax on high cost employer-sponsored health coverage, a.k.a., the "Cadillac tax.” This doesn’t mean that employers will be more generous, but it does mean that they will have more flexibility in plan design. This will encourage more employers to offer coverage. For a look at current employer prescription drug benefits, see Employer Pharmacy Benefits in 2016: More Specialty Drug Cost-Shifting Means More Problems for Patients.

- Medicaid will grow more slowly. The State Medicaid expansion will almost certainly be repealed and then phased out by 2018. Medicaid benchmark plans may also no longer be required to provide minimum essential health benefits. Ryan’s white paper (pages 26-28) proposes per capita allotments to the states, each of which would gain flexibility to design its own Medicaid benefit. This decentralization would make many state programs for the non-disabled population look more like commercial plans.

- Medicare Advantage will be a big winner. Medicare Advantage (MA) offers private plan options that cover services provided under Part A, Part B, and often Part D benefits. The Ryan plan strengthens MA. Given the aging population and Trump’s campaign promises, Medicare spending will continue to grow. More of the outpatient drug spend, however, will likely fall under MA prescription drug plans rather than stand-alone prescription drug plans (PDPs).

- The exchanges may not survive. The exchanges, a.k.a., the health insurance marketplaces, were created by the ACA and will almost certainly shrink sharply. These markets were already becoming unsustainable and would have required major fixes. To survive, they would need more flexible plan designs that are not limited to four metal tiers with rigid actuarial standards. We could also see a national insurance market rather than state-based markets. The subsidies would be phased out and possibly replaced by tax credits of some sort.

- Consumers may pay more. The Ryan white paper (page 15) proposes significant changes in the tax treatment of employer-sponsored insurance and encourages the use of health saving accounts. That’s why I model an increase in consumers’ share of spending.

Putting these speculations together yields the following provisional look at the source of payment under a repeal-and-replace scenario. For simplicity, I assumed the same overall drug spending in 2025.

[Click to Enlarge]

Of course, this SWAG will probably turn out to be wildly inaccurate. If you live by the crystal ball, then you must be prepared to eat broken glass. Yum!

No comments:

Post a Comment