Using MMIT’s proprietary data, Heather demonstrates that contracting for medical benefit drugs is now common for many therapeutic areas. She then highlights how manufacturers and payers are adopting value-based agreements (VBA) for medical benefit products—although VBA usage varies widely across therapeutic area. Heather also shares data on payers’ site-of-care management strategies.

For additional market insights, click here to learn about MMIT’s Biologics & Injectables Index.

Read on for Heather’s insights.

Key Trends in Medical Benefit Contracting and Value-Based Agreements

By Heather Roulston, Market Research Manager, MMIT

In recent years, the rising cost of specialty pharmaceuticals has motivated payers to implement tighter restrictions and seek both traditional and value-based contracts with manufacturers. As manufacturers are already contracting with GPOs, distribution networks and medical practices, most would prefer to avoid contracting with payers and PBMs for their medical benefit products.

However, given the widespread adoption of medical benefit contracting, this trend is unlikely to lose momentum. Manufacturers must evaluate their current market access and reimbursement strategies to determine if contracting could protect their existing coverage or potentially improve their products’ positioning. Relying on physicians to request medical exceptions is no longer likely to be a successful long-term strategy, even for less crowded therapeutic classes.

To better understand medical benefit trends, MMIT’s Index service surveyed payers from large national MCOs, regional MCOs, and PBMs encompassing 75% of commercial lives. The results reveal that medical benefit contracting is already robust across therapeutic areas. In the following takeaways from our research, all payer percentages are weighted to indicate the percentage of commercial lives covered.

INCREASED CONTRACTING ACROSS ALL CATEGORIES

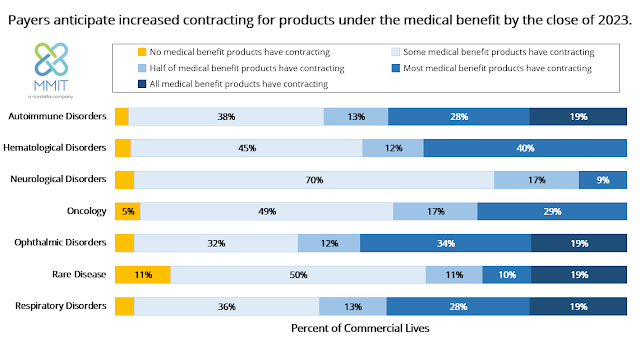

At the close of 2022, payers representing 51% of commercial lives reported contracting is in place for at least some medical benefit products, while payers representing 28% of lives said that most of their covered medical benefit products have contracting. By the end of 2023, payers representing 19% of commercial lives expect that all their medical benefit products used to treat autoimmune, respiratory, and ophthalmic disorders, as well as rare diseases, will be under contract.

Notably, almost half of commercial payers report the majority of their medically reimbursed respiratory (47%) and autoimmune (46%) therapies already have contracts in place. In the next year, payers anticipate an increase in medical benefit contracting for almost all indication categories, with the largest shifts in oncology and rare disease. In oncology, 46% of payers expect most or all medical benefit products to have contracting in place by the close of 2023, an increase of 11%.

[Click to Enlarge]

STEADY RISE IN VALUE-BASED AGREEMENTSFor years, the adoption of value-based contracting has been hampered by the inability of manufacturers and payers to agree upon reasonable metrics for reimbursement calculation. As more payers become capable of processing multiple metrics, there will be a growing demand for outcomes-based agreements for high-cost therapies.

MMIT data indicates that the use of value-based agreements (VBA) across medical benefit categories is steadily increasing. A majority of payers (56%) report sometimes using VBA contracts for medical benefit products, and 28% of payers use them frequently.

Reliance on VBAs varies significantly based on therapeutic area. Therapies used to treat rare diseases and hematological, neurological, and respiratory disorders are currently the most likely to be associated with a VBA. Between 35% to 40% of payers claim to never use VBAs for medical benefit therapies for autoimmune disorders, oncology and ophthalmic disorders, although these percentages are expected to drop within the next year for the latter two categories. In oncology, for example, 49% of payers report sometimes or often using VBAs for medical benefit products; by the end of the year, that percentage is expected to jump to 67%.

VARIABLE SITE-OF-CARE ENFORCEMENT

Manufacturers must also be careful to establish a sound distribution strategy to ensure patients have access to their medical benefit therapies. By tracking mandated site-of-care restrictions and specialty pharmacy requirements, manufacturers can ensure they have coverage in place for patients within every geographical region.

Although the overwhelming majority (79%) of payers mandate the use of preferred sites of care (SOC) across all medical benefit categories, 85% of these payers sometimes cover treatment at a non-preferred site. These exceptions vary significantly by category, with oncology and rare diseases as outliers; a respective 73% and 70% of payers will sometimes cover treatment at a non-preferred SOC for these conditions.

For the remaining categories, this figure drops to an average of 38% of payers covering non-preferred SOCs. Coverage for non-preferred SOCs is expected to stay steady for all categories this year except hematological disorders and rare disease. By the end of 2023, only 47% of payers expect to sometime cover rare disease treatments at a non-preferred SOC.

Nationally, the PBM consolidation trend is likely to drive increased medical benefit contracting as PBMs merge with large national payers and assume purchasing and distribution responsibilities. The high cost of specialty products has even prompted some regional plans to form their own contracting organizations, such as the Synergie Medication Collective for Blue Cross Blue Shield affiliates. Manufacturers of drugs covered under the medical benefit will need to be strategic about prioritizing payers and PBMs for both traditional and value-based contracts.

For more market research insights, learn about MMIT’s Biologics & Injectables Index and our special reports on Medical Benefit Trends and Patient Cost-Sharing.

Sponsored guest posts are bylined articles that are screened by Drug Channels to ensure a topical relevance to our exclusive audience. These posts do not necessarily reflect our opinions and should not be considered endorsements. To find out how you can publish a guest post on Drug Channels, please contact Paula Fein (paula@DrugChannels.net).

No comments:

Post a Comment