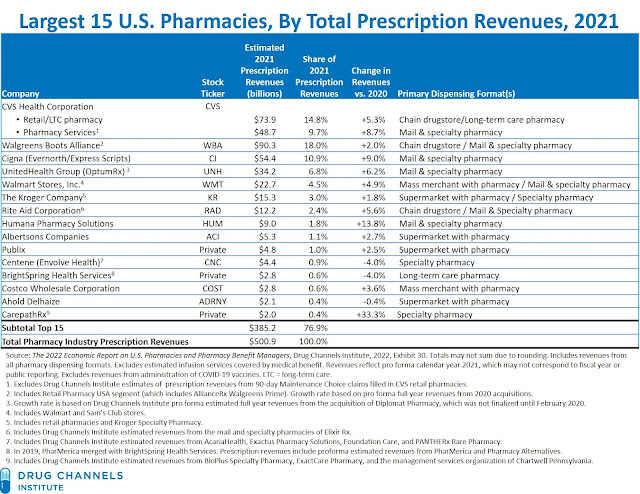

The exhibit below—one of 216 in our new report—provides a first look at the 15 largest organizations, ranked by total U.S. prescription dispensing revenues for calendar year 2021.

U.S. prescription dispensing revenues reached a record $501 billion in 2021. The total share of the largest 15 companies decreased slightly compared with their 2020 share, due primarily to below-market growth rates at retail and long-term care pharmacies. As I discuss below, upcoming business changes may reshuffle this list during 2022.

Read on as we cue up our latest update on the booming pharmacy and PBM marketplace.

For a sneak peek at the complete report, click here to download our free report overview (including key industry trends, the table of contents, and a list of exhibits). We’re offering special discounted pricing if you order before March 28, 2022.

RACK ‘EM UP: THE TOP 15

The table below shows DCI’s estimates of the largest pharmacies ranked by total prescription dispensing revenues for 2021, excluding revenues from the administration of COVID-19 vaccines.

[Click to Enlarge]

Observations on these figures:

- The top seven dispensing pharmacies—CVS Health, Walgreens Boots Alliance, Cigna, UnitedHealth Group, Walmart, Kroger, and Rite Aid—accounted for more than 70% of U.S. prescription dispensing revenues in 2021. The top 15 pharmacies accounted for nearly 77% of total dispensing revenues from retail, mail, long-term care, and specialty pharmacies.

The total share of the largest 15 companies decreased compared with their 2020 share, due primarily to below-market growth rates at retail and long-term care pharmacies. We discuss the market changes and acquisitions that affected the 2021 revenues and growth rates for the largest companies in the following sections of our new report: Section 2.3.3., Section 3.3.2., and Section 5.2.2.

- Consistent with prior years’ analysis, five of the largest pharmacies were central-fill mail and specialty pharmacies owned by the PBMs Caremark (CVS Health), Express Scripts (Cigna), Envolve Health (Centene), Humana, and OptumRx (UnitedHealth Group). The largest insurers, PBMs, and specialty pharmacies have now combined into vertically integrated organizations. The revenue figures in the chart above reflect combined dispensing revenues from all entities within these organizations.

- Revenue growth at the PBMs’ pharmacies is being driven by the dispensing of more-expensive specialty medications, which accounted for more than 38% of the pharmacy industry’s prescription revenues in 2021. As we show in Section 11.2.3. of our new report, specialty pharmacy dispensing and fees from manufacturers have become crucial to PBMs’ profitability.

Specialty drugs’ share of plan sponsor pharmacy benefit costs—after rebates—remains higher than their share of prescription revenues. This has led PBMs and third-party payers to aggressively manage specialty therapies. However, the specialty market is poised for significant change. In the coming years, both biologic and traditional specialty drugs will face increasing competition from biosimilar and generic versions of these products.

- The administration of COVID-19 vaccines has boosted retail pharmacies’ revenues and profits. Pharmacies have played a crucial role in the administration of COVID-19 vaccines. During 2021, retail pharmacies administered about 200 million doses of COVID-19 vaccines, including doses administered as part of the long-term care pharmacy program. Pharmacies administered about 29 million additional doses during the first five weeks of 2022.

We estimate that total pharmacy revenues (and gross profits) from administering COVID-19 vaccines were more than $7.5 billion through the end of 2021. Pharmacies’ operating profits from the COVID-19 vaccines were about 50% of revenues. To permit comparability with previous years’ figures, the prescription dispensing figures above exclude revenues from the administration of COVID-19 vaccines.

- The 2022 figures will be affected by expected business changes at some of the largest companies:

- Centene has acquired multiple companies to become one of the largest specialty pharmacy operators. However, the company plans to outsource its PBM operations to an external company. This will likely involve divesting its specialty pharmacy assets. It has apparently already begun the process of selling PANTHERx Rare Pharmacy, which it acquired just 15 months ago.

- As I predicted last year, Walgreens lost specialty pharmacy revenues in 2021 and will lose significantly more in 2022. AllianceRx Walgreens Prime (ARxWP) is no longer the exclusive mail and specialty pharmacy for Prime Therapeutics’ PBM beneficiaries. Many Prime’s plan sponsor clients have shifted to Express Scripts. Walgreens has projected that these client losses will reduce ARxWP’s revenues by $8 billion in 2021 and 2022. (FWIW, Walgreens also bought Prime’s 45% ownership in ARxWP.)

What’s more, Prime lost the specialty pharmacy benefit for the Federal Employee Program (FEP), which shifted back to CVS Health in January 2022. We estimate that this contract generated specialty revenues of approximately $3.7 billion for ARxWP in 2021.

NOTES FOR NERDS

Our estimated prescription revenue data may not correspond with figures from other public sources. That’s because:

- We have computed or estimated the figures on a calendar-year basis. The fiscal years for many public retail companies do not correspond to calendar years.

- Many companies do not report prescription revenues. We have therefore used various methods and sources to estimate the data.

- As noted in the footnotes to the table above, we have made various adjustments to account for the pro forma impact of mergers and acquisitions as well as certain client transitions among the largest PBMs. Year-over-year growth rates were also computed based on the prior year’s pro forma revenues. Pro forma revenues are computed based on the year in which an acquisition was completed.

- Unless otherwise noted, the figures for prescription dispensing revenues and profits in our new report (including the table above) exclude COVID-19 vaccinations that were administered in retail pharmacies. This omission permits more appropriate comparisons with previous years’ figures.

NOTE: The table has been updated to reflect the fact that Albertsons is a public company.

No comments:

Post a Comment