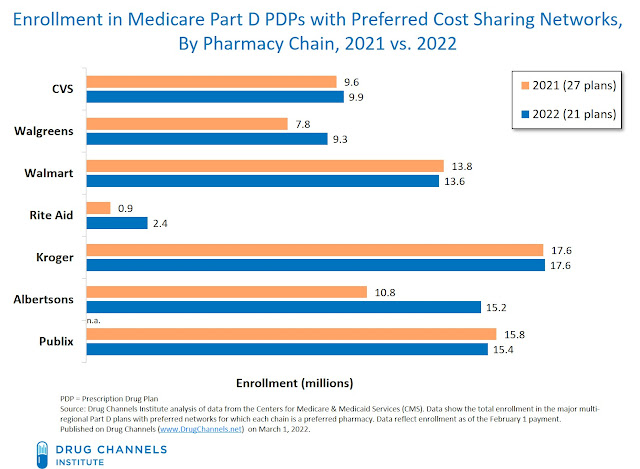

Below, we use the new enrollment data to examine the major pharmacy chains’ position within the 27 major Part D plans that have preferred networks. For the second year, the big supermarket chains—Albertsons, Kroger, and Publix—outpaced the big three drugstore chains and Walmart.

Supermarket pharmacies gained overall prescription market share in 2021, as we discuss in our forthcoming 2022 Economic Report on U.S. Pharmacies and Pharmacy Benefit Managers. Expect supermarkets to run even faster in 2022. What a strange world we live in!

DOWN THE DATA RABBIT HOLE

Last November, we published the following three-part series on the 2022 Medicare Part D market: For a deep dive into the economics and strategies of narrow network models, see Chapter 7 of our forthcoming 2022 Economic Report on U.S. Pharmacies and Pharmacy Benefit Managers.

For 2022, we examined the 21 stand-alone Part D plans offered by eight major companies. All of these plans have preferred cost sharing pharmacy networks. These companies will operate 685 regional PDPs, which equates to 89% of total regional PDPs. For each plan, we have identified the preferred status of seven large retail chains.

For the plans with preferred pharmacy networks, we also identified the preferred status of the largest seven retail chains. The open enrollment period for 2022 ran from October 15, 2021, to December 7, 2021. We used these data on enrollment: Medicare Advantage/Part D Contract and Enrollment Data. The figures include enrollment as of the February 1, 2022 payment, so they reflect 2022 trends. For each plan, we summed the total February enrollment.

Note that we examined stand-alone PDPs. A smaller share of Medicare Advantage Prescription Drug (MA-PD) plans have preferred networks.

CURIOUSER AND CURIOUSER

Based on the new enrollment figures, the 21 plans with preferred networks enrolled 18.5 million people. That equates to 97% of the total beneficiaries enrolled in a stand-alone Part D plan, and 98% of the total beneficiaries enrolled in a stand-alone Part D plan with a preferred network.

We used the enrollment data to measure each chain’s position in the 2022 preferred networks based on the open enrollment period. The chart shows the total enrollment in the plans for which each chain is a preferred pharmacy. For comparison, we include data from the 2021 open enrollment period.

[Click to Enlarge]

Here are the key trends for the largest retail chains:

- CVS pharmacy. For 2022, CVS Health’s retail pharmacies are preferred in plans that enrolled 9.9 million people. This figure is slightly higher than its 2021 position.

- Walgreens. Based on the initial enrollment data, 9.3 million people signed up for the nine plans in which Walgreens is a preferred pharmacy. This marks an improvement over the chain’s position in 2020 and 2021. Walgreens is the only national chain in the AARP MedicareRx Walgreens plan, which experienced enrollment growth of 8% for 2022.

- Walmart. Walmart is a preferred pharmacy in 17 of the 21 major preferred cost sharing networks. Consequently, 13.6 million people are enrolled in plans with Walmart as a preferred pharmacy. That’s comparable to the 2021 figure, but it’s a significant increase from its position in 2019, when a comparatively low 8.4 million enrolled in plans for which Walmart was a preferred pharmacy. Walmart is one of three national chains in the Humana Walmart Value Rx Plan. (Kroger and Publix are also preferred.) That plan’s enrollment grew significantly for the second consecutive year.

- Rite Aid. Rite Aid remains far behind its drugstore peers, though its fortunes have improved. For 2022, 2.4 million seniors enrolled in plans that have Rite Aid as a preferred pharmacy. That’s a big jump from the fewer than 1 million people for 2021. However, enrollment in the company’s Elixir plans dropped by 16% from 2021.

- Kroger/Albertsons/Publix. These supermarket chains continue to deepen their participation as preferred pharmacies. For 2022, Kroger is a preferred pharmacy in 18 major national plans that enrolled 17.6 million people. Albertsons is a preferred pharmacy in 16 plans that enrolled 15.2 million people—a notable increase from the 2021 figure. Publix is a preferred pharmacy in 13 plans that enrolled 15.4 million people.

THE RED QUEEN OF PHARMACY

In Lewis Carroll's Through the Looking-Glass, Alice competes in the Red Queen’s race. Alice keeps running, but stays in place.

In evolutionary theory, this metaphor has been adapted as the Red Queen hypothesis, which proposes that organisms must constantly adapt, evolve, and proliferate to survive while pitted against ever-evolving opposing organisms in an ever-changing environment. (source)

Chain pharmacies are trying to remain competitive and attract consumers in a saturated retail dispensing market. Pharmacies therefore have incentives to reduce their margins in exchange for maintaining market share. A pharmacy’s cost structure encourages such mad competition for network position. See my discussion of pharmacy prescription profits in Section 11.2.1. of DCI's forthcoming report.

Consequently, the reduction in pharmacy profits—via lower reimbursement from plans and/or higher direct and indirect remuneration (DIR) payments by pharmacies—remains the primary source of cost savings from narrow networks. Supermarkets have become increasingly willing to make these tradeoffs, while independents are retreating from narrow networks.

So, every pharmacy runs faster and faster–and complains evermore about the competitive environment. Such reimbursement pressure never leads to the extinction of retail pharmacy—though there are winners and losers. Am I mad as a hatter for pointing this out?

As the Red Queen says:

"You may call it nonsense if you like, but I've heard nonsense, compared with which that would be as sensible as a dictionary!"Just so.

No comments:

Post a Comment