- Thoughts on the recent insulin price cuts by Lilly, Novo, and Sanofi

- AbbVie gets tougher on alternative funding programs

- Optum quietly adds a new drug channel role

- A novel partnership emerges to modernize the 340B program

P.S. Join my more than 38,000 LinkedIn followers for daily links to neat stuff. You can also find my daily posts at @DrugChannels on Twitter, where I have more than 16,000 followers.

Join me for my new live video webinar, Discount Cards, Cost-Plus Pharmacies, and PBMs: Trends, Controversies, and Outlook, on March 31, 2023, from 12:00 p.m. to 1:30 p.m. ET. Click here to learn more and sign up.

Lilly Cuts Insulin Prices by 70% and Caps Patient Insulin Out-of-Pocket Costs at $35 Per Month, Eli Lilly and Company

Novo Nordisk to lower U.S. prices of several pre-filled insulin pens and vials up to 75% for people living with diabetes in January 2024, Novo Nordisk

Sanofi cuts U.S. list price of Lantus®, its most-prescribed insulin, by 78% and caps out-of-pocket Lantus costs at $35 for all patients with commercial insurance, Sanofi

Is the gross-to-net bubble finally starting to pop?

Over the past few weeks, the biggest insulin manufacturers—Eli Lilly, Novo Nordisk, and Sanofi—have all reduced the wholesale acquisition cost (WAC) list price of certain insulin products. This long-overdue move will start to address some of the warped incentives and patient problems that I have been covering for many years. The simultaneous list price reductions also limit PBMs’ ability to block the lower list price products (as they did with Semglee, the interchangeable biosimilar of Lantus).

Brand-name insulin products provide super deep rebates and therefore contribute disproportionately to the gross-to-net bubble. For 2021, average rebates and discounts for insulin were about $5,400 per-patient annually, while net drug costs were less than $1,100.

Consequently, health plans will no longer be able to subsidize premiums with insulin rebates. PBMs also won’t be able to earn fees based on insulin list prices. And 340B covered entities and their contract pharmacies will earn smaller profits from arbitraging insulin reimbursement vs. 340B acquisition costs.

One more observation: Medicaid rebates are linked to the bogus list price, which has been inflated by the gross-to-net bubble. The 100% cap on Medicaid rebates ends next year, which means that some companies with high-list/high-rebate products may have to pay Medicaid to use their products, i.e., negative prices. Anti-pharma zealots complain that insulin manufacturers are somehow “avoiding” Medicaid rebates. In reality, the manufacturers are rationally responding to Congressional incentives that encourage drugmakers to avoid having to pay the government for the use of their products.

The zealots are claiming that further lowering list prices was the Congressional plan all along. But that’s not accurate. The Congressional Budget Office (CBO) had assumed that companies would willingly pay Medicaid and 340B covered entities for every unit dispensed. Sigh.

In an upcoming post, I’ll share my outlook for the gross-to-net bubble and drug prices. You can find much more detail on the Medicaid rebate cap in Sections 9.1.3. and 12.5.2. in our new 2023 Economic Report on U.S. Pharmacies and Pharmacy Benefit Managers.

Over the past few weeks, the biggest insulin manufacturers—Eli Lilly, Novo Nordisk, and Sanofi—have all reduced the wholesale acquisition cost (WAC) list price of certain insulin products. This long-overdue move will start to address some of the warped incentives and patient problems that I have been covering for many years. The simultaneous list price reductions also limit PBMs’ ability to block the lower list price products (as they did with Semglee, the interchangeable biosimilar of Lantus).

Brand-name insulin products provide super deep rebates and therefore contribute disproportionately to the gross-to-net bubble. For 2021, average rebates and discounts for insulin were about $5,400 per-patient annually, while net drug costs were less than $1,100.

Consequently, health plans will no longer be able to subsidize premiums with insulin rebates. PBMs also won’t be able to earn fees based on insulin list prices. And 340B covered entities and their contract pharmacies will earn smaller profits from arbitraging insulin reimbursement vs. 340B acquisition costs.

One more observation: Medicaid rebates are linked to the bogus list price, which has been inflated by the gross-to-net bubble. The 100% cap on Medicaid rebates ends next year, which means that some companies with high-list/high-rebate products may have to pay Medicaid to use their products, i.e., negative prices. Anti-pharma zealots complain that insulin manufacturers are somehow “avoiding” Medicaid rebates. In reality, the manufacturers are rationally responding to Congressional incentives that encourage drugmakers to avoid having to pay the government for the use of their products.

The zealots are claiming that further lowering list prices was the Congressional plan all along. But that’s not accurate. The Congressional Budget Office (CBO) had assumed that companies would willingly pay Medicaid and 340B covered entities for every unit dispensed. Sigh.

In an upcoming post, I’ll share my outlook for the gross-to-net bubble and drug prices. You can find much more detail on the Medicaid rebate cap in Sections 9.1.3. and 12.5.2. in our new 2023 Economic Report on U.S. Pharmacies and Pharmacy Benefit Managers.

Application for Humira patient assistance, myAbbVie Assist

As regular readers know, I’ve been tracing the sad adoption rate of unethical alternative funding programs (AFPs), per The Shady Business of Specialty Carve-Outs, a.k.a., Alternative Funding Programs.

Unsurprisingly, manufacturers are trying to preserve these programs for needy and uninsured patients. Check out the following language from AbbVie’s patient assistance program enrollment form, which explicitly forbids “patient advocacy programs”:

A logical extension of AFPs would be for employers to remove coverage of major healthcare procedures and require employees to access nonprofit hospitals’ charitable assistance programs. Anti-pharma physicians, who are typically affiliated with a nonprofit medical center, do not appear to have ever contemplated such a scenario.

P.S. Hat tip to Christopher Brown of RxBenefits, who alerted me to this news via a LinkedIn post. In the comments to my LinkedIn repost, there’s a fascinating and hilarious debate between the pro- and anti-theft crowd.

Unsurprisingly, manufacturers are trying to preserve these programs for needy and uninsured patients. Check out the following language from AbbVie’s patient assistance program enrollment form, which explicitly forbids “patient advocacy programs”:

“Patients with insurance plans or employers participating in an alternate funding program (also sometimes referred to as patient advocacy programs, specialty networks, SHARx, Paydhealth, or Payer Matrix, among other names) requiring them to apply to a manufacturer’s patient assistance program or otherwise pursue specialty drug prescription coverage through an alternate funding vendor as a condition of, requirement for, or prerequisite to coverage of relevant AbbVie products, or that otherwise denies, restricts, eliminates, delays, alters, or withholds any insurance benefits or coverage contingent upon application to, or denial of eligibility for, specialty drug prescription coverage through the alternate funding program are not eligible for the myAbbVie Assist program. You agree to inform myAbbVie Assist if you are a member of such an insurance plan or if you are applying to myAbbVie Assist on behalf of a patient who is a member of such an insurance plan.”Note that AbbVie even calls out some of the more infamous market players.

A logical extension of AFPs would be for employers to remove coverage of major healthcare procedures and require employees to access nonprofit hospitals’ charitable assistance programs. Anti-pharma physicians, who are typically affiliated with a nonprofit medical center, do not appear to have ever contemplated such a scenario.

P.S. Hat tip to Christopher Brown of RxBenefits, who alerted me to this news via a LinkedIn post. In the comments to my LinkedIn repost, there’s a fascinating and hilarious debate between the pro- and anti-theft crowd.

Distribution Services Capabilities Manager – Remote, Optum

Hmm. Based on this job description (which is no longer available online), it sounds like Optum is quietly launching Optum Specialty Distribution, a wholesale distributor for buy-and-bill products. Unknown whether it will serve only internal Optum sites or also serve external customers.

The business seems analogous to CuraScript SD, the legacy Express Scripts specialty distribution business. ICYDK, Cigna currently buries CuraScriptSD within the “Other revenues” portion of its Evernorth segment.

Bonus: If Optum follows through with its plan, UnitedHealth Group will earn a checkmark in my new drug channel industry matrix.

The business seems analogous to CuraScript SD, the legacy Express Scripts specialty distribution business. ICYDK, Cigna currently buries CuraScriptSD within the “Other revenues” portion of its Evernorth segment.

Bonus: If Optum follows through with its plan, UnitedHealth Group will earn a checkmark in my new drug channel industry matrix.

Principles for Ensuring the 340B Program Benefits Patients and True Safety-Net Providers, Alliance to Save America’s 340B Program

An inevitable surprise? Community health centers and other non-hospital 340B covered entities are partnering with the Pharmaceutical Research and Manufacturers of America (PhRMA) to push for sensible reform of the out-of-control 340B Drug Pricing Program.

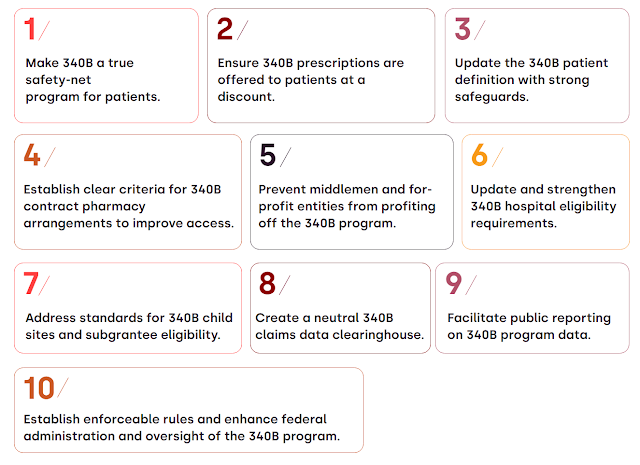

Check out this summary of their major themes:

As I have long warned: The good apples—the 340B entities that require additional financial support to support needy patients—should be worried that the bad ones could rot away the program for everyone.

Check out this summary of their major themes:

[Click to Enlarge]

As I have long warned: The good apples—the 340B entities that require additional financial support to support needy patients—should be worried that the bad ones could rot away the program for everyone.

Essential services: Quantifying the contributions of America’s pharmacists in COVID-19 clinical interventions, JAPhA

Here’s something dedicated to our many pharmacist readers. This JAPhA article provides a useful historical summary of pharmacists’ actions during the COVID-19 pandemic. In brief: 350+ million clinical interventions, including testing, parenteral antibodies, vaccinations, antiviral therapies, and inpatient care.

Note that the American Pharmacists Association funded the article, hence the celebratory tone. Still worthwhile, IMHO.

Note that the American Pharmacists Association funded the article, hence the celebratory tone. Still worthwhile, IMHO.

No comments:

Post a Comment